Disney Treasure shares the same layout as its sister ship, Disney Wish, but its interior spaces have unique decor and theming. The ship is dedicated to adventure and exploration, and some of its signature bars are inspired by iconic Disney theme park attractions.

Here, we give you a first look inside Disney’s newest cruise ship with photos from our ship tour. Stay tuned — TPG will be reporting from an actual sailing in December when we’ll get to experience the venues under full activation.

First impressions

Disney Treasure’s Grand Hall evokes the palaces of Africa and Asia, with a not-so-secret nod to Disney’s “Aladdin.” The central carpet has a fountain motif, and the elaborate chandelier pays homage to the six current ships in the Disney Cruise Line fleet.

In addition to being everyone’s first impression of the ship after embarkation, the Grand Hall is the site of various performances, including live music and storytelling by new characters, Coriander and Sage. (They will even perform after-hours stories for adults.)

From the Grand Hall, guests can set out in many directions to find adventure aboard Disney Treasure.

FOR NO-COST ASSISTANCE WITH PLANNING AND BOOKING YOUR NEXT DISNEY CRUISE, CHECK OUT TPG’S DISNEY BOOKING PARTNER,?MOUSE COUNSELORS.

Disney Treasure restaurants

Plaza de Coco

Plaza de Coco is a Mexican-inspired restaurant based on the movie “Coco” and is the ship’s new addition to the included dining rotation. The space is warm and inviting with rich colors, and the hallway leading to the venue sets the tone for the meal to come, complete with family photos and an ofrenda.

The dining experience here will include live mariachi music and dancing by the characters from the “Coco” film, with two distinct shows because guests will eat dinner here twice on a weeklong sailing. The first show has a family theme, while the second celebrates Dia de los Muertos.

Don’t miss the croquetas and the spicy chocolate tart dessert.

Worlds of Marvel

The Worlds of Marvel restaurant debuted on Disney Wish and returns on Treasure. The venue will feature the same show as Wish, “Quantum Encounter,” plus a second “Guardians of the Galaxy” show entitled “Marvel Celebration of Heroes: Groot Remix.”?

We saw the new show, which is sure to bring out all the good vibes with an adorable Groot. In between scenes, test your knowledge with superhero trivia.

Jumbeaux’s Sweets

Jumbeaux’s Sweets is a new ice cream parlor and candy shop inspired by Jumbeaux’s Cafe in the movie “Zootopia.” You can order all kinds of ice cream, sundaes in souvenir containers and many other treats.

While you’re here, look out for lemmings.

Disney Treasure bars

Skipper Society

Disney Treasure is introducing a handful of new, immersive bars with fun Disney themes. Skipper Society is inspired by Disney’s Jungle Cruise ride and its wisecracking skippers.

Expect lots of bad puns and drinks with a jungle theme. For a snack, try the waffles drizzled with nutella.

Periscope Pub

Periscope Pub takes its theme from Jules Verne’s “Twenty Thousand Leagues Under the Sea” (and Disney’s 1954 movie version of the book and theme park attraction).

The bar is the place to order craft beers, as well as extra-fee pub food, like a burger or soft pretzel. Don’t forget to look up as you never know which creatures will be swimming overhead.

The Haunted Mansion Parlor

The Haunted Mansion Parlor on Disney Treasure takes a seafaring approach to the creepy-yet-beloved Haunted Mansion theme park attraction.

The bar’s show, complete with a seance and a tale of a murder at sea, unfurls in five-minute increments over the course of 1.5 hours. Families are welcome to enjoy the spooky ambience and fun sodas and mocktails until 9 p.m. when the space becomes adults only.

Scat Cat Lounge

Just off the ship’s Grand Hall, the Scat Cat Lounge is inspired by Disney’s “The Aristocats” animated film.

It’s a swanky place to enjoy some jazz piano and cocktails served in glasses with cat faces. Signature drinks include tea-themed cocktails.

Other bars on board include the Hei Hei Cafe and Jade Cricket Cafe.

Disney Treasure’s cabins

Disney Treasure will have 1,256 cabins and suites ranging from windowless inside cabins to a two-story suite in the ship’s faux funnel. Cabin design will incorporate scenes from Disney movies like “Aladdin,” “Pocahontas,” “Finding Nemo,” “Up,” “Luca” and “Encanto.”

The Concierge Suites will feature nods to “The Lion King,” while the four Royal Suites pay homage to the tigers found in “The Jungle Book” and “Aladdin.”

The Royal Suites are incredible two-story suites with a living area downstairs and sleeping area upstairs, plus an expansive balcony with an infinity hot tub.

Related: Is Disney Cruise Line concierge level worth it? We tested it to find out

The most elaborate suite on the ship will be the two-story Tomorrow Tower Suite. The nearly 2,000-square-foot, multi-room suite features a futuristic design inspired by Epcot and can sleep up to eight guests. Due to its location in the ship’s faux funnel, it does not come with a private balcony.

Public spaces

Pool deck and AquaMouse

Disney Treasure’s pool deck is not just a watery playground, perfect for cooling off on hot days. It’s also the space for Disney’s signature deck parties, including the Pirate Night shows with fireworks.

Water ride AquaMouse returns on Disney Treasure with a third, new show in its rotation of animated shorts. Called “Curse of the Golden Egg,” the animation will follow Mickey and Minnie as they search for lost treasure inside an ancient temple.

Kids in diapers will have a blast at the Toy Story-themed splash area; I’m sure some adults will be tempted to play here, too.

Disney’s Oceaneer Club is one of the most creative kids clubs in the cruise industry, and Disney Treasure’s complimentary youth facilities are no exception. As with Disney Wish, kids (and adults) can enter the club via a slide from the Grand Hall.

Inside, a warren of adorable themed rooms offer an array of programming, from an Imagineering Lab to Marvel Academy and Fairytale Hall. Kids can design theme park rides and test them out in a ride simulator, or design their own superhero suit.

Adults can sample the fun during open house hours; otherwise, the Oceaneer Club is kids only.

Parents can drop off babies and toddlers at It’s a Small World Nursery for supervised nap and play time for an hourly fee.

Sarabi is a two-story activity space on board with a “Lion King” theme.

Broadway-style shows

Disney Treasure will debut “Disney The Tale of Moana” as its new Broadway-style musical. We got a sneak peek of Act 1, and the sets, puppets, costumes and choreography are breathtaking. The cast is one of the most diverse that Disney has ever had on a cruise ship, and Disney made sure that cultural consultants of Hawaiian and Samoan descent were involved in music and choreography choices.

The ship’s other shows will be “Seas the Adventure” and “Beauty and the Beast.”

Disney Treasure sets sail on its maiden voyage on Dec. 21, and will spend its debut sailing on alternating weeklong Eastern and Western Caribbean itineraries. Families and cruisers of all ages are going to love this ship for its warm, welcoming decor and cleverly themed spaces.

Planning a Disney cruise? Start with these stories:

- Cruise line showdown: Comparing Carnival, Disney and Royal Caribean for families

- 26 Disney cruise tips, tricks, secrets and extra magic to unlock when setting sail with Mickey

- Is a Disney cruise for adults? Here are 5 reasons why I say yes

- So you think you’re not a cruiser? Why this new ship may be the one to prove you wrong

- We tried a $10,000 concierge suite on Disney Wish to find out if it was worth the extra cost

]]>

The move comes after TPG, last month, reported the Fort Worth-based carrier was trialing the new software at three airports.

With an audible beep, the program alerts gate agents when a passenger tries to board with an earlier group than the one on their boarding pass.

American’s gate agents will also get a visual alert, TPG has learned, and they’ll ask passengers boarding out of turn to return when their group is called.

If you’re flying with a companion who’s assigned to a higher boarding group, you’ll be allowed to board with them. You’ll likely hear the system’s alert sound indicating you’ve boarded too early — but the gate agent can override it with a quick click.

Boarding groups are big business

Why this focus from American?

“Boarding is really important to our customers,” said Kim Cisek, American’s vice president of customer experience.

Indeed, it may sound trivial, but boarding groups are a key part of American’s value proposition for its higher-tier tickets, for AAdvantage elite status, and for customers who carry a cobranded American credit card.

Certain credit cards — along with elite status and premium-cabin tickets — come with higher-priority boarding groups.

And an earlier boarding group generally means more access to overhead bin space.

“Our customers want a calm boarding experience, they want it to be seamless, they want to be able to board with their group and not have other customers in front of them,” Cisek said, speaking to TPG exclusively last month at the airline’s Texas headquarters.

Just how often were travelers hopping in line ahead of their assigned group?

“It was happening often enough that we knew this was something we wanted to pursue,” Cisek acknowledged.

Expanding early trials

American trialed the technology at Albuquerque International Sunport (ABQ) in New Mexico, Tucson International Airport (TUS) in Arizona, and Ronald Reagan Washington National Airport (DCA) in recent weeks. The airline also ran some tests, Cisek said, at its home base, Dallas Fort Worth International Airport (DFW).

On top of barring travelers from boarding out of turn, American reports it’s seen an added perk at airports where it’s tested the technology: The airline has noticed passengers are generally crowing around the boarding area less, Cisek said.

American has nine boarding groups. Travelers who don’t have elite status but join the AAdvantage loyalty program typically board in Group 6.

Related reading:

- Your ultimate guide to American Airlines AAdvantage

- Best credit cards for American Airlines flyers

- American Airlines elite status: What it is and how to earn it

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

- Everything you need to know about flying basic economy on American Airlines

Thanks to Marriott’s partnership with Uber, Marriott Bonvoy members can earn Marriott points on Uber Eats deliveries and select Uber rides. This can help you get closer to your next free hotel stay.

For those who haven’t yet taken advantage of this partnership, there’s a new promotion that lets you earn 750 bonus points by simply linking your Marriott Bonvoy and Uber accounts — no rides or food deliveries required. The process is as simple as linking your accounts with a few taps on your phone. Frequent Miler first shared the news.

Keep reading to find out how to snag these limited-time bonus points and how to earn points on autopilot whenever you use Uber or Uber Eats.

Related: Earn more points and miles with Uber, Lyft and Starbucks apps

Earn 750 Marriott points with this promotion

We’ve seen similar deals in the past that required linking your accounts and taking a ride, but this one is even easier. All you have to do is link your Marriott Bonvoy account to your Uber account in the Uber app by Nov. 27, and you’ll get 750 bonus Bonvoy points. This bonus is only available to members who are linking their accounts for the first time.

Linking your accounts is quick and easy:

- Open the Uber app and tap “Account” in the bottom right.

- Tap “Settings” and scroll down to tap “Marriott Bonvoy” under the “Rewards” section.

- Tap “Link Account” and log in to your?Marriott Bonvoy account.

Voila, that’s it! You’ll see the following confirmation at the bottom of your settings.

Getting the bonus isn’t quite as fast. According to the promotion page, your 750 bonus points may take four to six weeks to appear in your Marriott Bonvoy account.

Related: 29 best Marriott hotels in the world

Keep earning Marriott points on Uber rides and food delivery

Once your accounts are linked, you’ll not only earn 750 bonus points, but you’ll also continue earning points on qualifying Uber rides and Uber Eats orders.

You’ll earn points as follows:

- 2 points per dollar spent on U.S. UberX Reserve rides and 3 points per dollar spent on U.S. Uber Premium rides (includes UberXL, Uber Black, Uber SUV and Uber Comfort)

- 2 points per dollar spent on Uber Eats restaurant and grocery orders of $40 or more delivered to Residence Inn, TownePlace Suites and Element hotels in the U.S.

- 1 point per dollar spent on Uber Eats restaurant and grocery orders of $40 or more elsewhere in the U.S.

Marriott says it could take a few business days for Bonvoy points to post after eligible Uber rides and food deliveries. However, based on the TPG team’s experiences, the points typically post almost immediately.

If you want to maximize your rewards while still earning Marriott Bonvoy points, consider paying with a credit card that earns?bonus points or miles on Uber rides or?food delivery so you can effectively double dip.

Gabrielle Bernardini, TPG’s senior points and miles editor, maximizes her rewards by using The Platinum Card? from American Express, which offers Uber Cash — $15 each month, plus a $20 bonus in December — to use for Uber rides or Uber Eats in the U.S. (make sure your Amex Plat is added to the Uber account and you can redeem with any Amex card). She then earns 1 American Express Membership Rewards point per dollar spent beyond those credits, which TPG values at 2 cents apiece, according to our November 2024 valuations. This is in addition to bonus Marriott points.

Related: Baby on board: You can now book Uber with a car seat in 2 major cities

Bottom line

Since this promotion ends Nov. 27, now is a great time to link your Marriott and Uber accounts and earn 750 bonus Bonvoy points, even if you don’t plan to use Uber or Uber Eats anytime soon. All future qualifying rides and orders will earn you valuable Marriott Bonvoy points that you can redeem toward free nights.

]]>While mileage earning of AAdvantage miles and Loyalty Points between American and Dublin-based Aer Lingus was implemented in December 2023, new benefits are now available for elite members of American’s Advantage program when they fly with Aer Lingus and elite Aer Lingus AerClub members when they fly with American.

Keep reading to find out the details below.

Related: American Airlines elite status: What it is and how to earn it

AAdvantage elite members can enjoy perks when flying Aer Lingus

AAdvantage Gold members can enjoy the following new benefits when flying with Aer Lingus:

- 40% bonus miles (a total of 7 miles per dollar spent on base fares and carrier-imposed surcharges)

- Priority check-in

- Priority boarding

AAdvantage Platinum members can enjoy:

- 60% bonus miles (a total of 8 miles per dollar spent on base fares and carrier-imposed surcharges)

- Priority check-in

- Fast-track security

- Priority boarding

- Lounge access with one guest

- One additional checked bag in economy class

AAdvantage Platinum Pro members can enjoy:

- 80% bonus miles (a total of 9 miles per dollar spent on base fares and carrier-imposed surcharges)

- Priority check-in

- Fast-track security

- Priority boarding

- Lounge access with one guest

- One additional checked bag in all classes

AAdvantage Executive Platinum members can enjoy:

- 120% bonus miles (a total of 11 miles per dollar spent on base fares and carrier-imposed surcharges)

- Priority check-in

- Fast-track security

- Priority boarding

- Lounge access with one guest

- One additional checked bag in all classes

Aer Lingus is part of the International Airlines Group, which owns Oneworld partners British Airways and Iberia. From Dec. 2, 2024, AerClub elite members can also enjoy new benefits when flying with British Airways. Members will be notified of the exact benefits in the coming days, according to a press release from Aer Lingus.

Aer Lingus operates its own lounges at Dublin Airport (DUB) — including a new U.S. Preclearance lounge called 51st&Green — plus London’s Heathrow Airport (LHR) and New York City’s John F. Kennedy International Airport (JFK). It also allows eligible passengers to access American Airlines Flagship Lounges and Admirals Clubs at all U.S. locations when departing, connecting or arriving on Aer Lingus-operated flights.

The news follows recent expansions to Aer Lingus’ U.S. route network. With the delivery of the new Airbus A321XLR aircraft, the airline will launch nonstop service from Nashville International Airport (BNA) to DUB?four times per week from April 12, 2025, and from Indianapolis International Airport (IND) to DUB, also four times per week but from May 3, 2025.

The carrier will operate 24 transatlantic routes to North America and the Caribbean in 2025.

At this time, you cannot redeem AAdvantage miles to book award travel on Aer Lingus; however, American’s website states that this reciprocal perk is “coming soon.”

Bottom line

While the benefits of this airline partnership for travelers have been slow to materialize, it is great to see that elite members of American Airlines’ AAdvantage program can now enjoy various travel perks when flying Aer Lingus to Ireland or beyond.

If you hold elite status in the AAdvantage program, remember to add your membership number to your next Aer Lingus booking to take “advantage” of the new perks.

]]>Editor’s note: This is a recurring post, regularly updated with new information and offers.

If you’re looking to boost your travel with a nice haul of transferable points, you might want to think about one of Citi’s most viable cards on the market.

New Citi Strata Premier? Card?(see rates and fees) cardholders can earn 75,000 bonus points after spending $4,000 on purchases within the first three months of account opening.

According to TPG’s November 2024 valuations of ThankYou points at 1.8 cents apiece, that’s a bonus worth $1,350.

In the past, Citi has offered up to 80,000 ThankYou bonus points — and while that’s a pretty solid deal, 75,000 ThankYou points also offer tons of value. It’s worth noting this card underwent a very minor refresh in May; the annual fee stayed the same while some new benefits were introduced.

Let’s dive deeper into Citi’s Strata Premier Card to see what other perks it offers.

Earning points on the Strata Premier

Aside from the potential points haul the welcome bonus offers, the Citi Strata Premier is one of the best earners among rewards credit cards thanks to its various bonus categories. They include:

- 10 ThankYou points per dollar on hotels, car rentals and attractions when booked through CitiTravel.com

- 3 points per dollar at restaurants

- 3 points per dollar at supermarkets

- 3 points per dollar at gas stations and electric vehicle charging stations

- 3 points per dollar on air travel?and?hotels

- 1 point per dollar on all other purchases

What can you do with Citi ThankYou points?

What’s particularly valuable about ThankYou points is the ability to utilize the issuer’s 21 airline and hotel transfer partners.

After you meet the initial spending requirement of $4,000 in the first three months, you’ll have 75,000 ThankYou points — and many more if you’ve spent in the bonus categories listed above — that you can use to book travel that includes flights and hotels.

If you value simplicity, the 75,000-point welcome bonus will let you book $750 of paid travel directly through the Citi ThankYou travel portal.

You’ll earn miles and elite status on these flights by redeeming points this way, and you don’t have to worry about award availability. You could also redeem your points for $750 in gift cards.

TPG credit cards writer Danyal Ahmed is a huge fan of the Citi Strata Premier and utilizes his points exclusively by transferring them to some of Citi’s transfer partners.

He finds value in programs such as Air France-KLM Flying Blue, thanks to their standardized award chart between the U.S. and Europe. It offers business-class tickets for 50,000 points one-way, with the ability to add a free stopover.

Danyal also often transfers his Citi ThankYou points to Qatar Airways Privilege Club to book their renowned Qsuite business-class product.

Related:?Everything you need to know about ThankYou points

Things to consider

Here’s the specific verbiage on application restrictions for this offer:

Bonus ThankYou? Points are not available if you have received a new account bonus for a Citi Premier? or a Citi Strata Premier? account in the past 48 months.

Additional perks offered by the Citi Strata Premier include:

- $100 annual hotel credit (on single hotel stay bookings of $500 or more, excluding taxes and fees, booked through CitiTravel.com or by calling 1-833-737-1288)

- Free FICO credit score monitoring

- Citi Quick Lock so you can block new purchases without interrupting recurring ones

- Lost wallet protection for emergency cash

- Citi Concierge access

- Complimentary ShopRunner membership

- No foreign transaction fees

- Citi Entertainment

- Extended warranty on purchases

The card also offers the following travel protections:

- Trip cancellation and interruption protection

- Trip delay protection

- Lost or damaged luggage insurance

- Car rental coverage

Bottom line

Between the welcome bonus, extra points earned through the ThankYou portal, earning 3 points per dollar on a wide range of popular bonus categories and valuable transfer partners, the Citi Strata Premier Card is a great travel rewards credit card.

You can easily rack up ThankYou points through everyday spending on gas, EV charging, groceries and dining purchases without a cap on how many points you can earn.

To learn more, read our full review of the Citi Strata Premier Card.

Apply here: Citi Strata Premier

Related: Better together: Why the Citi Strata Premier and Rewards+ cards are a great pair

]]>While tens of thousands line up to see the parade in person or watch the balloons get blown up on the Upper West Side the day before, you don’t need to go outside to see some of the new balloons and floats.

TPG got a special preview.

This year’s parade features more than 5,000 volunteers, 34 floats, 22 giant character balloons, seven of what Macy’s calls “balloonicles,” 11 marching bands and 28 clown crews. That’s not to mention the musical stars, Broadway performances and, of course, Santa Claus, which will all flow from Central Park West to Macy’s home base at West 34th Street and Sixth Avenue.

Here’s what you can expect to see next week.

New Macy’s Thanksgiving Day Parade floats and balloons

Gabby — the star of the hugely popular “Gabby’s Dollhouse” series from DreamWorks Animation —? will make her parade debut this year. The Gabby balloon is painted with more than 25 colors, and a new movie starring Gabby and her famous cat Pandy Paws will be coming in 2025.

Related:?Holiday airfare is rising: What to know if you haven’t booked yet

There are several other new balloons and floats for 2024, including Spider-Man; Marshall from “Paw Patrol;” a newly designed Goku, the legendary hero of the “Dragon Ball” franchise; and Santa’s magical arctic fox Extraordinary Noorah, joined by The Elf on the Shelf.

Here are a few more.

Dora’s Fantastical Rainforest by Nickelodeon

Dora the Explorer is back for the first time in 15 years. “Exciting discoveries await Dora & her best friend Boots” as she returns to the parade, Macy’s said. “Accompanied by her reliable map & back pack, Dora is prepared to navigate the tropical terrain & New York City streets while keeping her eyes & ears peeled for Swiper the mischievous fox.”

Pasta Knight by Rao’s Homemade

This year, a cool dragon represents the famous New York restaurant Rao’s and its Rao’s Homemade brand of pastas and sauces.

The Rao’s Homemade Pasta Knight is here to slay a hunger dragon, with a backdrop designed to resemble a village in Southern Italy. Macy’s said it was inspired by the origin of Rao’s Homemade authentic Italian marinara sauce. Look closely, and you’ll see the knight is made from pasta shapes like orecchiette, fusilli and rigatoni, among others.

Wondrous World of Wildlife by the Bronx Zoo

My favorite float was the Wondrous World of Wildlife entry from the Bronx Zoo right here in New York City. This famous park has been amazing visitors for the past 125 years. “From Amur tigers to western lowland gorillas to giraffes, these are just some of the extraordinary creatures you can encounter on your next visit to the Bronx Zoo,” according to Macy’s.

Each animal on the float was designed to be the same size as its real-life counterpart. During the actual parade, Idina Menzel will perform on the float.

Magic Meets the Seas by Disney Cruise Line

The Magic Meets the Seas float from Disney Cruise Line features unique design details from eight of the Disney Cruise Line ships. Take a look at the fun character art adorning the bows.

Strikes Again by Go Bowling

This fully kinetic “balloonicle,” powered by an electric battery, features the Go Bowling Bowler, who resembles an animatronic character straight out of a theme park. This is a fun new addition to the lineup.

Related:?Your guide to the can’t-miss holiday happenings in New York City

Wednesday’s Feast by Netflix

They’re creepy and they’re kooky, mysterious and spooky. They’re altogether ooky. They’re the Addams family, and they will be represented by Wednesday and Pugsley Addams in the parade thanks to a cool float sponsored by Netflix. The Macy’s Studios team said it spent over 100 hours meticulously sculpting the faces of the “Addams Family” characters for the parade.

Minnie Mouse

For the first time in parade history, Disney’s Minnie Mouse will be strolling the streets of New York City in her iconic polka-dot bow and signature yellow pumps. Minnie is five stories tall — that’s 60 feet tall and 60 feet long.

Candy Cosmos by Haribo

Haribo makes delicious gummies, and they make cute parade floats and balloons, too. The company has more than 25 gummies products on the market. Can you name all the types shown on its float?

Bottom line

Hopefully, our preview of the Macy’s Thanksgiving Day Parade made you want to attend in real life at some point. We have a complete guide to everything you need to know to plan a trip and see the balloons in person.

Related reading:

]]>Senate Bill 1838 would require credit card-issuing banks to offer a minimum of two networks for merchants processing electronic credit card transactions, prohibiting Visa and Mastercard from acting as a duopoly as the largest market share of cards. The bill claims forced competition would lower fees charged by merchants for consumers using their credit cards.

Sens. Roger Marshall, R-Kan, and Richard Durbin, D-Ill., introduced the bipartisan legislation in 2022 before reintroducing it with additional support in 2023, including from Vice President-elect J.D. Vance. Despite momentum from high-profile public support, including from President-elect Donald Trump, the bill has largely remained stalled for most of 2023 and 2024 thus far.

The lack of movement beyond its introduction did not stop the Senate Judiciary Committee from holding its final hearing on the bill this year. During the hearing, members largely urged Visa and Mastercard to modify their practices prior to congressional action.

Sen. Thom Tillis, R-N.C., reiterated his belief that the bill would not pass in this Congress. He suggested that the bill would actually “create more problems.” However, he urged the two credit card operators to act on their own before congressional intervention.

“The solution coming from Congress will not be good for anyone,” he said on Tuesday.

Tillis had support from Sen. Josh Hawley, R-Mo., who has garnered a reputation for being among the most outspoken members of Congress, despite being a junior senator.

“This is not a sustainable solution,” he said. “I am here to tell you this will not stand.”

Hawley was the only member who offered an alternative to the bill. He piggybacked on previous proposals, including those by both himself and Trump, to require credit card companies to cap interest rates to lower the $1.14 trillion debt among American credit card users. Reporting on those efforts, which have also been proposed by Democrats, suggests that the credit card industry would similarly oppose that legislation in the way it has with the Credit Card Competition Act.

If the Credit Card Competition Act were currently up for a vote, Louisiana Republican Sen. John Kennedy said he “didn’t know how he would vote,” but that Congress would act in some form or fashion … eventually.

Kennedy directly addressed Visa and Mastercard representatives at the hearing and said there were two possible outcomes.

“When we are done with you, you could end up looking like either the post office or the Dallas Cowboys,” he said. His office did not respond to a request for comment by the time of publication seeking clarification on his statement.

Critics, including Airlines for America, warn that the bill would negatively affect loyalty programs, such as those offered by cobranded credit cards.

Airlines for America is a trade group representing major North American airlines such as United Airlines, American Airlines and Delta Air Lines. It launched an anti-legislation campaign highlighting this concern called Protect Our Points. (TPG is among the many organizations with a vested interest in this cause and launched its own campaign, Protect Your Points. The campaign is in collaboration with the Electronic Payments Coalition, which advocates for credit unions, community banks, payment card networks and other banking institutions involved in the electronic payment process.)

“This hearing was so blatantly biased and one-sided, it practically needed a disclaimer saying it was bought, paid for, and sponsored by the campaign donations of the nation’s largest corporate mega-stores,” Electronic Payments Coalition executive chairman Richard Hunt said in a statement following the hearing.

In response to the bill’s claims that competition would lower fees for consumers and small businesses, the group pointed to a Congressional Research Service report. The report concludes that the bill is “unlikely to lower prices for consumers or help small businesses,” citing a lack of evidence that credit card routing mandates yield savings for consumers.

Financial industry critics of the bill routinely reference the Durbin Amendment, which established a fixed fee on debit card transaction processing in lieu of a percentage fee based on the total transaction. The Durbin Amendment is largely blamed for limiting rewards banks offered for debit card purchases and, therefore, terminating most debit card perks for consumers.

If history is any precedent, credit card loyalty programs could falter in the same way. If frequent flyer programs are curtailed, travelers could see airlines respond to a revenue loss by raising costs for travelers, such as the price of airfare.

“It turns out that most of the airlines make more money on the credit card branded cards and frequent flyer programs than they do on airline operations,” Durbin noted. “This legislation scares the living hell out of them.”

Various tourism industry stakeholders oppose the bill, warning it could negatively impact state tourism.

“If signed into law, this bill could suppress travel and tourism by eliminating the foundation of credit card rewards and loyalty programs that countless visitors to Florida — as well as Floridians — rely on to travel,” nine Miami-area stakeholders wrote in a letter to Republican Florida Sens. Marco Rubio and Rick Scott, which was shared with TPG. These stakeholders include the Greater Miami Convention & Visitors Bureau, Greater Miami & the Beaches Hotel Association and the Greater Miami LGBTQ Chamber of Commerce.

Proponents say the proposed legislation will improve competition within credit card exchanges, as Visa and Mastercard account for a large proportion of general-purpose credit cards.

On Nov. 18, the American Bankers Association spearheaded an opposition letter to chairman Durbin and ranking member Lindsey Graham, a South Carolina Republican. According to the letter, the bill would “open the door to fraud, hamper rewards programs, and limit the allocation of credit to individuals and small businesses.”

In contrast, Sen. Peter Welch, D-Vt., said Visa and Mastercard fees are “killing small businesses in America” at the hearing, despite small businesses relying on Visa and Mastercard to process payments.

The European Union capped interchange fees in 2015 at 0.2% of the transaction value for consumer debit cards and 0.3% for Visa and Mastercard consumer credit cards. Bill Sheedy, senior adviser to the CEO of Visa, said this resulted in the majority of the loyalty programs being eliminated or greatly devalued.

“Those changes were bad for European consumers due to higher fees and thus fewer rewards,” he said. Indeed, the credit card rewards landscape in Europe is much smaller than in the United States. Europeans have access to very few high-value sign-up bonus credit cards or charge cards.

Bottom line

As of Nov. 20, the Credit Card Competition Act has yet to progress beyond committee discussion. Based on Tuesday’s Senate Judiciary Committee hearing, this bill is not likely to pass this congressional session.

In the interim, bill supporters urged Visa and Mastercard to pursue a path of modification outside of a congressional mandate.

“The most liberal and conservative members agree we have to do something about this,” Durbin said. “What the hell is going on here?”

It’s worth noting that Durbin is up for reelection in 2026, and he has not confirmed whether he will be seeking it. Even if he retires, the bill appears to have enough bipartisan support to remain relevant.

Related reading:

]]>“I think we’ll probably see at least one more European destination next year,” JetBlue president Marty St. George predicted, speaking last week at an aviation industry conference in Dallas.

That would be notable considering the New York-based carrier has, in recent months, pulled back a bit on its transatlantic schedule — at least, for the colder months.

JetBlue’s evolving Europe strategy

As part of a larger network shake-up this year, JetBlue just cut its wintertime flying to London Gatwick Airport (LGW) and scaled back in Paris. Instead, the carrier is sending more of its Mint-equipped Airbus jets to popular warm-weather destinations like San Juan, Puerto Rico; Phoenix; and Las Vegas during the off-peak months in Europe.

It was JetBlue’s first real pullback in Europe after adding five destinations there?— its first five ever — over the past three years.?

All year, in fact, JetBlue executives have signaled the carrier’s future European expansion would be more measured — or “opportunistic,” as CEO Joanna Geraghty put it when I spoke with her this spring.?

Still bullish on transatlantic travel …

None of that, though, is to say that the airline is done adding new overseas destinations to its network.

After all, there are additional, popular European cities that JetBlue’s longest-range Airbus A321 aircraft could conceivably reach from its hubs at New York’s John F. Kennedy International Airport (JFK) and Boston Logan International Airport (BOS).

And JetBlue continues to see its across-the-pond service as a key part of its recipe for success, even as the carrier has doubled down on its East Coast leisure roots.

“Europe’s been a very important market for us, and especially for loyalty. There’s a lot of pent-up demand for our customers to fly to Europe,” Christopher Buckner, JetBlue’s vice president of loyalty programs and partnerships, said when speaking to TPG in September.

To Buckner’s point, JetBlue recently announced a deal-sweetener for high-paying travelers flying to Europe: Transatlantic Mint passengers will get complimentary access to the airline’s first-ever airport lounges at JFK and BOS that are planned to open beginning in late 2025.

When to go: These are the best times to buy an international flight

… But growth will be limited

At the same time, don’t expect to see JetBlue’s nonstop Europe route map balloon too much more in the next few years. The airline’s future aircraft delivery plans are limiting on that front, St. George said, noting the airline expects delivery of two long-range Airbus A321XLR jets in 2025. Beyond that, though, no long-range aircraft are slated to join the fleet until 2030.

“So, from an aircraft perspective, we’re going to be relatively constrained,” St. George told the Dallas audience.

Dublin and Edinburgh, Scotland, to return in 2025

Despite those constraints, JetBlue plans to bring back two seasonal Europe routes launched in 2024 for a second season. That’s good news for travelers eyeing trips to Ireland or Scotland.

“We did some experimenting this summer with Dublin and Edinburgh,” St. George said. “They’re both coming back in summer 2025; they’ve been great.”

Along with those Emerald Isle and Scottish destinations, JetBlue’s transatlantic route map currently includes year-round service to London, Paris and Amsterdam.

Despite pulling back on its European growth this winter, the carrier’s total seats across the Atlantic in 2024 are up 66% over 2023, according to data from aviation analytics firm Cirium.

Speculation around domestic first class grows

Meanwhile, JetBlue isn’t exactly putting to rest speculation over an onboard product that would likely fly a bit closer to home — that is, if it ever became a reality.

Earlier this year, TPG reported that some Wall Street analysts had begun predicting that the carrier seemed poised to announce a new domestic first-class-style cabin for some of its jets. That much-theorized cabin has even garnered a nickname in some industry circles: “Junior Mint,” an ode to JetBlue’s most premium cabin. (JetBlue has not announced any such cabin, nor coined that nickname.)

‘Junior Mint’ speculation grows

Talk of this “Junior Mint” theory grew louder in July when JetBlue executives teased a forthcoming announcement about a new “premium product” for the airline.

Weeks later, JetBlue did,?in fact, make a big premium product announcement, but it wasn’t a first-class cabin. It was the new lounge portfolio for JFK and BOS.

Last month, the carrier made an additional pseudo-premium announcement, revealing it will soon repackage its extra-legroom Even More Space seats into a new, mid-tier fare offering called “Even More.”

Farewell to visions of first-class recliners? Not quite.

At last week’s industry conference in Dallas, veteran aviation journalist Brian Sumers of The Airline Observer?asked St. George directly whether JetBlue is planning a domestic first-class-style cabin, citing the swirling rumors.

“I can’t comment about anything like that. I will say that we are looking at the best way to use the real estate on the airplane. It’s too soon to make any sort of announcement,” St. George said.

But based on the success JetBlue has seen from its Mint and Even More Space products, St. George added, “It’s certainly something we’ve thought about.”

Only time will tell whether the comments ultimately foreshadow an additional future premium cabin announcement.

Far clearer, though, is that JetBlue does lack the spacious recliners and premium service at the front of its planes on short-haul routes to match up with its perpetually highly rated Mint cabins, a bona fide international business-class-level product featuring lie-flat pods.

Hefty premium product budget

We should also point out that JetBlue has budgeted $400 million for premium product initiatives between 2025 and 2027 as part of the company’s overarching plan called “JetForward,” meant to return the carrier to profitability for the first time since the coronavirus pandemic.

Buckner, speaking to me in September, confirmed that the hefty budget for premium product initiatives goes well beyond the carrier’s JFK and BOS lounge plans.

“Our lounge products and loyalty are a pillar in that overall $400 million,” Buckner said. “So there will be other initiatives as well.”

Related reading:

- The best time to book flights for the cheapest airfare

- Best airline credit cards

- What exactly are airline miles, anyway?

- 6 real-life strategies you can use when your flight is canceled or delayed

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

If you’ve been using your debit card for all your purchases for years — carefully tracking your checking account balance and not spending more than what you have in the bank — shifting your spending to a credit card can be a big change.

I used to be one of those people who?paid for everything with their debit card because they were afraid of racking up debt. I thought?debit cards were the safe spending option since you can’t spend more money than what you had in your account.

At the time, that was what financial responsibility looked like for me. However, my perspective changed as my interest in travel grew, and I learned that I could earn big rewards by applying for and using credit cards.

Maybe you already have a rewards credit card but are hesitant to shift your spending to credit cards. You’ve possibly signed up for a credit card and charged enough to meet the minimum spending requirement for a bonus, but after that, you always return to using your debit card.

If you’ve been on the fence about switching your spending from debit to credit, here are a few tips to help you make the change.

Related: Credit vs. debit cards: Which is the smarter choice?

Adjust your mindset

When I first decided to shift my spending to credit cards, I knew I wanted to be a responsible credit card user. I didn’t view a credit card as free money or a long-term loan to repay over time through minimum payments.

Paying interest was a no-go, which meant not charging more than I could pay back each month.

One thing that helped me is that I treated my credit card just like my debit card. That meant not spending more than I had in the bank. Even though my credit card did not withdraw directly from my checking account for every purchase (as my debit card did), I acted as if it did.

Maybe you made only minimum payments on credit cards in the past. If so, paying it in full will require adjusting your mindset. View your credit card just like a debit card. Don’t spend more than you can pay back every month.

Related: The best way to pay your credit card bills

Know your credit limit

You’ll want to avoid accidentally exceeding your credit limit on a lower-limit card. If you do, transactions may be declined, or you may be charged fees. But you also shouldn’t view cards with high limits as a free pass to max out your card.

Keeping your balance within a reasonable limit of your available credit can boost your credit score. Your credit utilization ratio makes up 30% of your FICO score, so keeping your balance in check is important.

Related: TPG’s 10 commandments of credit cards

Start with just one card

Maximizing your points- and miles-earning often involves strategizing which cards to use for different purchases. As many cards come with category bonuses — bonus points for different types of spending, such as restaurants or gas stations?— it can be quite lucrative to use different cards for different purchase categories.

That might mean using an American Express? Gold Card for 4 points per dollar at restaurants worldwide (on up to $50,000 in purchases per calendar year, then 1 point per dollar) and U.S. supermarkets (on up to $25,000 in purchases per calendar year, then 1 point per dollar).

However, remembering which card to use for each purchase can feel overwhelming if you’re new to travel rewards and using your credit card for everything.

A good way to maximize points earned using only one card at a time is through new card welcome bonuses. Open a new credit card and use only that card until you meet the minimum spending requirement (which is required to earn the welcome bonus), being sure to pay off your balance in full every month.

Once that’s complete, apply for another card and shift all your spending to that card. You’re generating lots of points by earning welcome bonuses, even though you may not utilize all of the bonus categories you could maximize by juggling multiple cards.

But remember that some issuers — including American Express, Chase and Bank of America — limit the number of cards you can be approved for over a certain period of time.

Once you’re comfortable with consistently paying your balance off in full every month, you can add more complexity, like switching your spending to different cards to take advantage of category bonuses.

Related: The ultimate guide to credit card application restrictions

Shift any automatic payments

Automatic payments make life easier by knocking one more thing off the to-do list. If you have automatic transactions using your checking account or debit card and use your credit card for other purchases, tracking your finances can get complicated. There’s more to manage. Keep it simple by shifting as many automatic payments as possible to your credit card.

You likely can’t use your credit card to autopay everything. Your mortgage and car payments are good examples. You’ll still have to track those in your checking account.

Yes, some services will?accept your credit card for a fee and send a check to your loan company or other merchants, but you’ll have to weigh whether the fee is worth it for you.

For your other bills — such as your cellphone,?utilities,?fitness club membership?and streaming services — it should only take a few minutes to update your payment online, and then you’ll start earning rewards for those purchases.

Related: 4 ways to manage your spending on multiple credit card accounts

Review your transactions

Whether you check your credit card account daily or monthly, it’s important to take the time to ensure all your transactions post correctly.

You’re not just reviewing transactions for the correct amounts, but you should review your points earned to verify you’ve earned the correct amount of points. And check for any statement credits you expect to receive, such as from Chase Offers or Amex Offers.

Related: How to identify and prevent credit card fraud

Set up autopay or schedule manual payments

You don’t want to forget a payment and incur late fees and interest. While some card issuers may waive late charges and interest as a one-time courtesy, you shouldn’t get in the habit of paying late.

Determine a payment schedule that works best for you. Some people pay weekly; others pay monthly. If you’re afraid of overspending and not having the money in your checking account to pay the bill, don’t wait until the due date. You can make multiple payments, even paying off balances daily or weekly.

If you’re concerned you may forget to pay your bill, you should set up?autopay for your full balance (ideal) or the minimum balance by the due date. Alternatively, set reminders on your phone for each credit card, ideally a week in advance and again a couple of days before your due date.

Related: How to set up autopay for all your credit cards

Bottom line

I’m a longtime travel rewards enthusiast, and I spend significant time and energy learning how to maximize my spending and earn rewards. However, it can feel like everyone is signing up for new credit cards (and spending thousands of dollars on them) to generate points for first-class flight redemptions and luxury hotel stays.

But that’s not the case. Even still, I’m still surprised when a friend or family member pulls out a debit card to pay for a purchase. Even though they may be interested in travel rewards, moving from a debit card to a credit card can be nerve-wracking, and I understand that.

Switching from debit to credit was one of my best money moves. My only regret is not doing so sooner.

Related: 4 reasons why you shouldn’t use your debit card (except at ATMs)

]]>Most of the time, I’m an economy traveler. Even on international long-haul flights, I generally choose to forgo a lie-flat seat to save my points and miles. At this point in my life, the number of trips I can take per year with my points is far more important than splashing out on a luxury flight experience, even if that means sacrificing some sleep and comfort on longer flights. And honestly, I’m rarely on an international flight that lasts more than seven or eight hours maximum.

But when Virgin Atlantic Flying Club rolled out its new dynamic pricing for Virgin Atlantic-operated flights, I found a deal too good to pass up and started focusing on the Flying Club program properly for the first time.

Thanks to Virgin Atlantic’s new dynamic pricing on award flights and a timely Chase transfer bonus, I booked my first lie-flat, round-trip business-class flight for just 42,000 credit card points (plus taxes and fees).

Here’s how you can, too.

Stacking a great deal with a great transfer bonus

While some Flying Club points rates now skyrocket to 350,000 points each way for Virgin Atlantic’s Upper Class (business class), flexible travelers can also score great deals via Flying Club’s new Saver fares.

Related: Flexibility is key: Why I (mostly) like the Virgin Atlantic Flying Club changes

More out of curiosity than any actual plan to book a trip, I did a few sample searches in late October to help co-workers understand the new Flying Club changes.

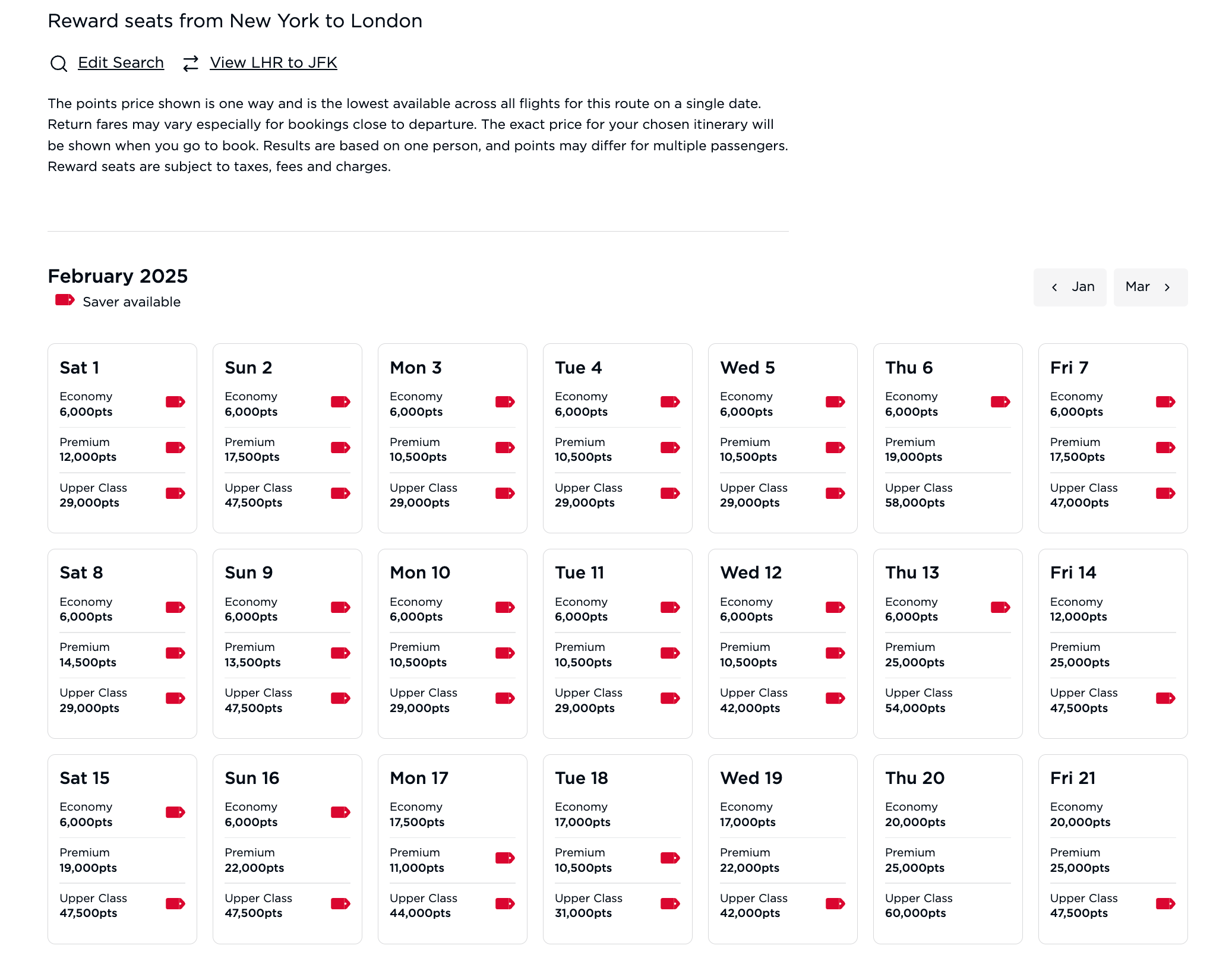

Multiple dates throughout the first half of 2025 were available for just 29,000 points (plus taxes and fees) each way in lie-flat business class between New York City’s John F. Kennedy International Airport (JFK) and London’s Heathrow Airport (LHR).

For comparison, that’s about what you’d pay to fly economy on American Airlines from New York to London in the spring of 2025. I’ve earned more than double that on rent payments alone this year with my Bilt Mastercard? (see rates and fees).

But what turned this great deal into a “you’d be silly not to book this” deal in my head is the current Chase transfer bonus in place. Through Nov. 30, you get an extra 40% when you transfer your Chase Ultimate Rewards points to Flying Club. That means this trip went from costing 58,000 points round-trip to just 42,000 points round-trip (or 21,000 points each way).

The downside is the taxes and fees,?which are typically much higher for business-class seats than economy tickets. But while $870 in taxes and fees round-trip certainly isn’t cheap, paying less than $900 all-in for transatlantic business-class seats that would have easily cost $3,000-plus had I paid in cash still classifies as a fantastic deal, and the surcharges are much lower than the $2,000-plus Flying Club charged before the program switched to dynamic pricing.

Despite not planning to book a trip that day, I felt foolish not to jump on this deal. I had no idea how long this amazing new Saver pricing on Virgin Atlantic would be available, and the transfer bonus ends at the end of November. I’ve never been to London, and I’ve never flown lie-flat business class. I had the points available to transfer, and they transferred instantly. Award flights are refundable, and it was close to the same price I’d typically pay for an economy ticket with other airlines.

Needless to say, I booked it.

Related: The best cheap (or absolutely free) things to do in London

How you can book Virgin Atlantic Flying Club Saver fares

While some Saver seats have now been snapped up for the specific dates I booked in March, Virgin Atlantic does have a Reward Seat Checker calendar tool where you can find Saver availability as it fluctuates — not just for New York City to London, but also across other routes like Orlando International Airport (MCO) to Edinburgh Airport (EDI).

The key is to have a stash of credit card points ready to transfer and the flexibility to jump on a deal when you see it.

First, check Virgin Atlantic’s Reward Seat Checker for an easy way to see points prices at a glance, and look for those prices with a red “Saver” tag to ensure you’re paying the lowest price.

If you find a deal you want to book, search more specifically for those dates on Virgin Atlantic’s site to find the specific flight you want and confirm the points you’ll need. I found round-trip flights on dates I wanted in March for 29,000 points each way, meaning I needed 58,000 points total.

Next, transfer points from the issuer of your choosing. Of course, if you book this trip before the end of November, it’s best to use your Chase points to take advantage of that 40% transfer bonus. Regardless of when you look to book, you can check with each issuer (or our regularly updated guide to transfer bonuses) to ensure you’re transferring for the best value.

Ensure you know how many points you need to transfer, including the bonus. On Chase’s Ultimate Rewards platform, you won’t be shown explicitly what the end amount of points will be on Virgin after you transfer, so you’ll have to break out those rusty high school math skills.

For example, here’s how the breakdown worked for my flights: I needed 58,000 points in my Virgin Atlantic Flying Club account to book these Saver flights. To account for the 40% transfer bonus, I divided that total number of points by 1.4 (the .4 representing the 40% transfer bonus). That left me with 41,428.571 points. Given that you have to transfer points in increments of 1,000, I rounded up and transferred 42,000 points to Virgin Atlantic.

After transferring your points, ensure you’re logged in to your Virgin Atlantic account. TPG staffers have found that Ultimate Rewards point transfers to Flying Club are instantaneous; however, transfer times are not universal and it may take longer for the points to hit your account. Once your points are in your account, it’s just a few clicks to book!

TPG always recommends finding availability before transferring points, as point transfers are irreversible.

How to earn Virgin points

Virgin points are easy to earn, with Flying Club being a transfer partner of every major program with a transferable currency:

- American Express Membership Rewards?(at a 1:1 ratio)

- Bilt Rewards?(1:1)

- Capital One?(1:1)

- Chase Ultimate Rewards?(1:1)

- Citi ThankYou Rewards?(1:1)

- Wells Fargo Rewards?(1:1)

- Marriott Bonvoy?(3:1, with a 5,000-point bonus for transferring 60,000 points;?48-hour transfer time)

It’s worth noting that Capital One miles transfer to Virgin Red, not directly to Virgin Atlantic Flying Club. However, you can?easily use your Virgin Red account points?with Flying Club.

Check out these card options to earn reward points and miles to book Flying Club award seats (all offer terrific welcome bonuses):

- The Business Platinum Card? from American Express

- The Platinum Card? from American Express

- American Express? Gold Card

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Ink Business Preferred? Credit Card

- Chase Sapphire Preferred? Card

Bottom line

I’m far from a Virgin Atlantic aficionado — this is the first flight I’ve ever booked through Flying Club. But it was still a fairly straightforward process to search for flights, find out how many points I needed and transfer the points from my Chase account to book my flights. One of my friends who had never transferred points also took advantage of this deal and said similar things about how easy it was to transfer and book.

I’m pumped to take my first international lie-flat business-class flight, and knowing I snagged it for essentially the same points price as an economy flight makes this redemption all the sweeter.

While the Virgin Atlantic dynamic price changes have pros and cons (especially for families), if you are flexible with your travel dates and keep a ready-to-transfer stash of points available, you can snag some fantastic deals like this one.

Related reading:

- Key travel tips you need to know — whether you’re a beginner or expert traveler

- Premium economy vs. business class: Are the differences worth an upgrade?

- Maximize your airfare: The best credit cards for booking flights

- What are points and miles worth? TPG’s monthly valuations

- 7 of the best airline award chart sweet spots

See Bilt Mastercard rates and fees?here.

See Bilt Mastercard rewards and benefits?here.