Disney Treasure shares the same layout as its sister ship, Disney Wish, but its interior spaces have unique decor and theming. The ship is dedicated to adventure and exploration, and some of its signature bars are inspired by iconic Disney theme park attractions.

Here, we give you a first look inside Disney’s newest cruise ship with photos from our ship tour. Stay tuned — TPG will be reporting from an actual sailing in December when we’ll get to experience the venues under full activation.

First impressions

Disney Treasure’s Grand Hall evokes the palaces of Africa and Asia, with a not-so-secret nod to Disney’s “Aladdin.” The central carpet has a fountain motif, and the elaborate chandelier pays homage to the six current ships in the Disney Cruise Line fleet.

In addition to being everyone’s first impression of the ship after embarkation, the Grand Hall is the site of various performances, including live music and storytelling by new characters, Coriander and Sage. (They will even perform after-hours stories for adults.)

From the Grand Hall, guests can set out in many directions to find adventure aboard Disney Treasure.

FOR NO-COST ASSISTANCE WITH PLANNING AND BOOKING YOUR NEXT DISNEY CRUISE, CHECK OUT TPG’S DISNEY BOOKING PARTNER,?MOUSE COUNSELORS.

Disney Treasure restaurants

Plaza de Coco

Plaza de Coco is a Mexican-inspired restaurant based on the movie “Coco” and is the ship’s new addition to the included dining rotation. The space is warm and inviting with rich colors, and the hallway leading to the venue sets the tone for the meal to come, complete with family photos and an ofrenda.

The dining experience here will include live mariachi music and dancing by the characters from the “Coco” film, with two distinct shows because guests will eat dinner here twice on a weeklong sailing. The first show has a family theme, while the second celebrates Dia de los Muertos.

Don’t miss the croquetas and the spicy chocolate tart dessert.

Worlds of Marvel

The Worlds of Marvel restaurant debuted on Disney Wish and returns on Treasure. The venue will feature the same show as Wish, “Quantum Encounter,” plus a second “Guardians of the Galaxy” show entitled “Marvel Celebration of Heroes: Groot Remix.”?

We saw the new show, which is sure to bring out all the good vibes with an adorable Groot. In between scenes, test your knowledge with superhero trivia.

Jumbeaux’s Sweets

Jumbeaux’s Sweets is a new ice cream parlor and candy shop inspired by Jumbeaux’s Cafe in the movie “Zootopia.” You can order all kinds of ice cream, sundaes in souvenir containers and many other treats.

While you’re here, look out for lemmings.

Disney Treasure bars

Skipper Society

Disney Treasure is introducing a handful of new, immersive bars with fun Disney themes. Skipper Society is inspired by Disney’s Jungle Cruise ride and its wisecracking skippers.

Expect lots of bad puns and drinks with a jungle theme. For a snack, try the waffles drizzled with nutella.

Periscope Pub

Periscope Pub takes its theme from Jules Verne’s “Twenty Thousand Leagues Under the Sea” (and Disney’s 1954 movie version of the book and theme park attraction).

The bar is the place to order craft beers, as well as extra-fee pub food, like a burger or soft pretzel. Don’t forget to look up as you never know which creatures will be swimming overhead.

The Haunted Mansion Parlor

The Haunted Mansion Parlor on Disney Treasure takes a seafaring approach to the creepy-yet-beloved Haunted Mansion theme park attraction.

The bar’s show, complete with a seance and a tale of a murder at sea, unfurls in five-minute increments over the course of 1.5 hours. Families are welcome to enjoy the spooky ambience and fun sodas and mocktails until 9 p.m. when the space becomes adults only.

Scat Cat Lounge

Just off the ship’s Grand Hall, the Scat Cat Lounge is inspired by Disney’s “The Aristocats” animated film.

It’s a swanky place to enjoy some jazz piano and cocktails served in glasses with cat faces. Signature drinks include tea-themed cocktails.

Other bars on board include the Hei Hei Cafe and Jade Cricket Cafe.

Disney Treasure’s cabins

Disney Treasure will have 1,256 cabins and suites ranging from windowless inside cabins to a two-story suite in the ship’s faux funnel. Cabin design will incorporate scenes from Disney movies like “Aladdin,” “Pocahontas,” “Finding Nemo,” “Up,” “Luca” and “Encanto.”

The Concierge Suites will feature nods to “The Lion King,” while the four Royal Suites pay homage to the tigers found in “The Jungle Book” and “Aladdin.”

The Royal Suites are incredible two-story suites with a living area downstairs and sleeping area upstairs, plus an expansive balcony with an infinity hot tub.

Related: Is Disney Cruise Line concierge level worth it? We tested it to find out

The most elaborate suite on the ship will be the two-story Tomorrow Tower Suite. The nearly 2,000-square-foot, multi-room suite features a futuristic design inspired by Epcot and can sleep up to eight guests. Due to its location in the ship’s faux funnel, it does not come with a private balcony.

Public spaces

Pool deck and AquaMouse

Disney Treasure’s pool deck is not just a watery playground, perfect for cooling off on hot days. It’s also the space for Disney’s signature deck parties, including the Pirate Night shows with fireworks.

Water ride AquaMouse returns on Disney Treasure with a third, new show in its rotation of animated shorts. Called “Curse of the Golden Egg,” the animation will follow Mickey and Minnie as they search for lost treasure inside an ancient temple.

Kids in diapers will have a blast at the Toy Story-themed splash area; I’m sure some adults will be tempted to play here, too.

Disney’s Oceaneer Club is one of the most creative kids clubs in the cruise industry, and Disney Treasure’s complimentary youth facilities are no exception. As with Disney Wish, kids (and adults) can enter the club via a slide from the Grand Hall.

Inside, a warren of adorable themed rooms offer an array of programming, from an Imagineering Lab to Marvel Academy and Fairytale Hall. Kids can design theme park rides and test them out in a ride simulator, or design their own superhero suit.

Adults can sample the fun during open house hours; otherwise, the Oceaneer Club is kids only.

Parents can drop off babies and toddlers at It’s a Small World Nursery for supervised nap and play time for an hourly fee.

Sarabi is a two-story activity space on board with a “Lion King” theme.

Broadway-style shows

Disney Treasure will debut “Disney The Tale of Moana” as its new Broadway-style musical. We got a sneak peek of Act 1, and the sets, puppets, costumes and choreography are breathtaking. The cast is one of the most diverse that Disney has ever had on a cruise ship, and Disney made sure that cultural consultants of Hawaiian and Samoan descent were involved in music and choreography choices.

The ship’s other shows will be “Seas the Adventure” and “Beauty and the Beast.”

Disney Treasure sets sail on its maiden voyage on Dec. 21, and will spend its debut sailing on alternating weeklong Eastern and Western Caribbean itineraries. Families and cruisers of all ages are going to love this ship for its warm, welcoming decor and cleverly themed spaces.

Planning a Disney cruise? Start with these stories:

- Cruise line showdown: Comparing Carnival, Disney and Royal Caribean for families

- 26 Disney cruise tips, tricks, secrets and extra magic to unlock when setting sail with Mickey

- Is a Disney cruise for adults? Here are 5 reasons why I say yes

- So you think you’re not a cruiser? Why this new ship may be the one to prove you wrong

- We tried a $10,000 concierge suite on Disney Wish to find out if it was worth the extra cost

]]>

Black Friday and Cyber Monday sales are almost upon us, and if you’re anything like us, you likely already have a few items on your Amazon watch list. While the actual sales are yet to officially begin, we’re already seeing a smattering of price drops across various items on Amazon and other retailers (not to mention, some great early hotel deals).

After Amazon Prime Day, the Black Friday and Cyber Monday sales are some of the best ways to save money on everything from headphones to household staples. Whether you are gearing up to save some cash during the sales or looking for deals on any of the other days of the year, here are ways you may be able to save money on your next Amazon “add to cart” moment.

Use points

After filling your Amazon cart, you might have noticed the “Shop with Points” option at checkout. This is not always the best use of your credit card points from a monetary value perspective, as you can often get better value from your points when redeeming for travel.

Sometimes, though, promotions award money off your Amazon order even when using a small number of points.

At any given time, various targeted American Express offers give cardholders the opportunity to save. In the past, TPG staffers with eligible American Express cards have been targeted to save between 10% and 40% on Amazon orders using as few as 1 American Express Membership Rewards point. Offer terms vary, but the concept remains relatively the same. If one of these offers is available for your account, it can be a great way to save on your next Amazon order.

To be eligible, you must link your eligible Amex card(s) to your Amazon account to shop with Membership Rewards points.

We regularly check for new offers. If you haven’t already, we suggest you do the same to make sure you’re not already eligible for an offer. Bookmark any offers pages to check again later if you’re not eligible right now.

Related: Save up to 50% on Amazon purchases using just 1 Amex point

Earn bonus points with the right credit card

If you have an American Express card, see if you’ve been targeted for any Amex Offers. These offers vary from account to account and can be a great way to rack up bonus Membership Rewards points or save money on purchases you would make anyway.

Amazon periodically appears in Amex Offers.

The trick here is to check your Amex account frequently to see if you’re eligible to earn bonus points or additional savings. You must manually add these offers to your Amex account and then use that card to pay for your Amazon orders.

TPG’s November 2024 valuations peg Amex Membership Rewards points at 2 cents each, so getting 5 points per dollar spent at Amazon is like earning 10 cents in rewards per dollar spent. To start accessing these Amex Offers, a couple of good American Express cards to consider that don’t even come with annual fees are:

- Blue Cash Everyday? Card from American Express (see rates and fees)

- Hilton Honors American Express Card (see rates and fees)

Use an Amazon credit card

While we’re discussing the best credit cards for Amazon purchases, let’s talk about Amazon’s own card: the Prime Visa.

It doesn’t have an annual fee, and new cardholders will receive a $200 Amazon gift card immediately upon approval. You can use the gift card straight away for sale purchases. The card is only available to Prime members, so factor that in when deciding if it is the right match for you.

The card usually awards 5% cash back at Amazon and Whole Foods Market; 2% cash back on restaurant, gas station, and local transit and commuting purchases; and 1% cash back on everything else.

Related: Prime Visa card review: A good choice for regular Amazon shoppers

Use coupons

This tip won’t come as a surprise, but if you see a coupon available on Amazon, be sure to click on it.

You’ll know if there’s a coupon available for your item, as there will be an icon that says “Coupon” below the price. The coupon will be activated if you check the box next to it. Coupons are sometimes only for a few cents or dollars, but saving money is saving money.

Some items will also let you save by subscribing for repeat deliveries.

Track prices and set price alerts

It’s hard to know just how good a sale is if you haven’t been pricing a certain item for a while. One site that can tell you the historical price of an item on Amazon — and even alert you to price drops — is CamelCamelCamel.

This website can help you gauge just how good a sale is. If it’s not an urgent purchase, you can also use this site to help you decide whether or not to hold off on buying an item until you get a better price through a sale or price drop.

Get credit for no-rush shipping or pickup

If you have time to spare, you can opt for no-rush shipping on your items and save them for an “Amazon Day Delivery.” This way, you’ll earn a credit that you can use for future digital purchases such as select e-books, music, videos and apps. The amount of the credit varies, but, based on my tests, it often totals up to a couple of dollars.

You’ll find this option during checkout when you’re prompted to enter your shipping information.

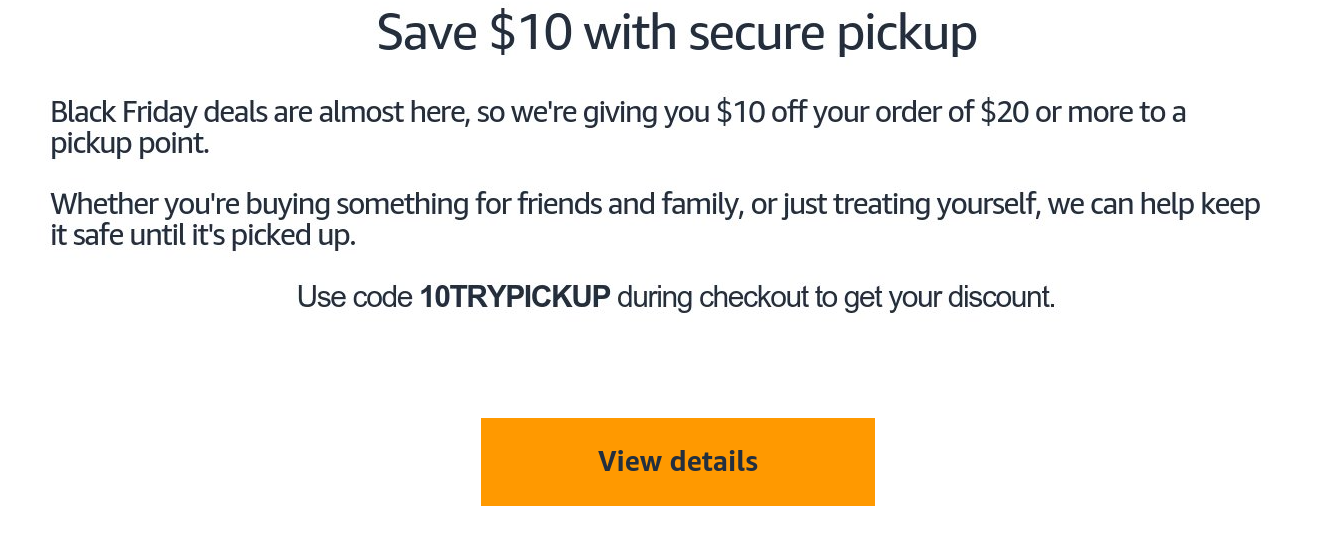

If you decide to send your order to an Amazon pickup point (rather than your home), you may be rewarded with a promotion. In the past, we’ve seen $10 credits on future $20 Amazon orders by using a code and retrieving orders at an Amazon Hub, such as an Amazon Locker or Locker+.

Sign up for a free Amazon Prime trial

If you’re not already an Amazon Prime member, you might be able to sign up for a free 30-day trial of Amazon Prime. It’s a great, free way to try out the service if you haven’t already. You’ll be able to receive free, two-day shipping on eligible items and also get access to Prime Video. After that, if you don’t cancel, the plan increases to $14.99 every month.

Purchase Amazon gift cards

If the credit cards in your wallet don’t offer any points or cash-back bonuses for Amazon, you can also purchase Amazon gift cards at grocery stores with a credit card that gives bonus rewards at that specific retailer.

For example, if you buy a $100 Amazon gift card at the grocery store and pay for that purchase with the Blue Cash Preferred? Card from American Express, you can earn 6% cash back on that purchase (on up to $6,000 per year in purchases at U.S. supermarkets, then 1%). Cash back is received as Reward Dollars that can be redeemed as a statement credit or at amazon.com checkout.

Bottom line

From having the right credit card to using American Express Reward Dollars for purchases, there are several ways to save money while shopping at Amazon. Bookmark this page for the upcoming Black Friday and Cyber Monday sales and beyond.

Related reading:

- Amex Blue Cash Preferred card review: Generous bonus categories and a solid welcome offer

- How to redeem your points and miles for Amazon purchases

- The do’s and don’ts on how to maximize your holiday purchases

- Earn bonus points and miles: How to maximize shopping portals for Black Friday and holiday deals

For rates and fees of the Blue Cash Everyday, click here.

For rates and fees of the Hilton Honors Amex, click here.

While Citi offers many different rewards credit cards, only some Citi credit cards provide access to the company’s valuable ThankYou Rewards program. You’ll also need to hold a premium Citi ThankYou card in order to gain full access to Citi ThankYou Rewards transfer partners.

Whether you’re applying for your first credit card or are a seasoned pro looking for a new travel rewards card, one or more cards in Citi’s portfolio might be right for you.

In this guide, we’ll examine the program in more detail, including some of the best cards offering Citi ThankYou points and how to redeem them.

Best Citi ThankYou Rewards cards

- Citi Prestige? Card: Best for restaurants, airlines and travel agencies

- Citi Strata Premier? Card: Best for earning full-fledged ThankYou points with a low annual fee (see rates and fees)

- Citi Rewards+? Card: Best for supermarkets, gas stations and small purchases (see rates and fees)

- Citi Double Cash? Card: Best for everyday spending (see rates and fees)

- Citi Custom Cash? Card: Best for bonus earnings in different categories each billing cycle (see rates and fees)

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

| Card | Sign-up bonus | Earning rates | Annual fee | Standout benefits |

| Citi Prestige Card | This card is not available to new applicants. |

|

$495 |

|

| Citi Strata Premier Card | Earn 75,000 bonus points after spending $4,000 on purchases within the first three months of account opening. |

|

$95 (see rates and fees) |

|

| Citi Rewards+ Card | Earn 20,000 bonus points after spending $1,500 on purchases within three months of account opening. |

|

$0 (see rates and fees) |

|

| *Citi Double Cash Card | Earn $200 in cash back after spending $1,500 on purchases in the first six months of account opening. Note that this bonus will be fulfilled as 20,000 ThankYou points, which can then be redeemed for $200 cash back. |

|

$0 (see rates and fees) |

|

| *Citi Custom Cash Card | Earn $200 in cash back after spending $1,500 on purchases in the first six months of account opening. Note that this bonus will be fulfilled as 20,000 ThankYou points, which can then be redeemed for $200 cash back. |

|

$0 (see rates and fees) |

*Note that Double Cash and Custom Cash cardholders will earn cash back in the form of ThankYou points.

How to earn Citi ThankYou points

As you can see, many Citi cards earn ThankYou points. But not all ThankYou points are created equal.

TPG’s November 2024 valuations peg the value of Citi ThankYou Rewards points at 1.8 cents each, but we base our valuation on the potential value you can get by transferring your ThankYou points to one of the program’s airline or hotel partners. However, to transfer points to most Citi ThankYou transfer partners, you must hold a premium Citi ThankYou Rewards card like the Citi Prestige Card (which is no longer accepting new applications) or the Citi Strata Premier Card.

If you only have the Citi Rewards+ Card, the Citi Double Cash Card or the Citi Custom Cash Card (or another nonpremium Citi ThankYou card), you’ll earn what we’ll call “basic” ThankYou points. They’re worth 1 cent each when redeemed for cash back via a statement credit, direct deposit or check.

You can also transfer “basic” ThankYou points to three loyalty programs — Choice Privileges, JetBlue TrueBlue and Wyndham Rewards — if you have the Citi Rewards+ Card or the Citi Double Cash Card, but these transfers will occur at a lower rate than if you had a premium Citi ThankYou card.

However, suppose you also hold the Citi Prestige Card or the Citi Strata Premier Card. In that case, you can combine the “basic” ThankYou points into your Citi Prestige or Citi Strata Premier account and transfer your rewards to all the Citi ThankYou travel partners at the best transfer ratios.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

If you want to add a new Citi ThankYou card to your wallet, read the fine print for the sign-up bonus and check our page on credit card application rules to ensure you’re eligible for the bonus before clicking the “Apply” button.

Related:?The best time to apply for these popular Citi credit cards, based on offer history

How to redeem Citi ThankYou points

All the Citi ThankYou Rewards cards let you redeem ThankYou points for statement credits, cash rewards, third-party gift cards and travel booked through the Citi travel portal at a flat rate of 1 cent per point. Sometimes, you’ll even find gift cards on sale that could give you a slightly higher redemption rate.

Be careful, though, as some redemption options (such as Shop With Points) provide less than 1 cent per point. Ensure you are getting at least 1 cent per ThankYou point before you redeem.

Keep in mind that you may get significantly more value when you redeem your ThankYou points by transferring them to airline or hotel partners. Suppose you don’t have a premium ThankYou Rewards card like the Citi Prestige Card or the Citi Strata Premier Card. In that case,?you can only transfer to Choice Privileges, JetBlue TrueBlue and Wyndham Rewards if you have the Citi Rewards+ Card or the Citi Double Cash Card (and your transfer ratio won’t be as lucrative).

Check out the following table for the transfer ratios.

| Program | Transfer ratio |

| Aeromexico Rewards | 1:1 |

| Accor Live Limitless | 2:1 |

| Air France-KLM Flying Blue | 1:1 |

| Avianca LifeMiles | 1:1 |

| Cathay Pacific Cathay | 1:1 |

| Choice Privileges | 1:2 (2:3 with non-premium cards) |

| Emirates Skywards | 1:1 |

| Etihad Guest | 1:1 |

| EVA Air Infinity MileageLands | 1:1 |

| I Prefer Hotel Rewards | 1:4 |

| JetBlue TrueBlue | 1:1 (5:4 with nonpremium cards) |

| Leaders Club (Leading Hotels of the World) | 5:1 |

| Miles&Smiles (Turkish Airlines) | 1:1 |

| Qantas Frequent Flyer | 1:1 |

| Qatar Airways Privilege Club | 1:1 |

| Singapore Airlines KrisFlyer | 1:1 |

| Thai Royal Orchid Plus | 1:1 |

| Virgin Atlantic Flying Club/Virgin Red | 1:1 |

| Wyndham Rewards | 1:1 (5:4 for non-premium cards) |

With so many transfer partners, your options are plentiful when redeeming Citi ThankYou Rewards points. Here are some Citi ThankYou sweet spots you could use in some of the programs that tend to provide the most value:

- Transfer to Singapore KrisFlyer and snag a Spontaneous Escapes deal.

- Transfer to Choice Privileges and redeem between 8,000 and 50,000 Choice points per night in most destinations.

- Use Avianca LifeMiles to book one-way United Airlines-operated awards within the U.S. for as little as 6,500 LifeMiles and $5.60 in taxes and fees one-way in economy.

- Use Virgin Atlantic Flying Club to fly on Delta Air Lines-operated flights.

- Transfer to Wyndham Rewards and redeem as few as 7,500 Wyndham points per night (or even less if you have select Wyndham credit cards).

- Transfer to Air France-KLM Flying Blue to book a Flying Blue Promo Rewards flight.

Related:?Redeem your points and miles: How to search flight award availability for the major airlines

Bottom line

Citi ThankYou Rewards points are perhaps the most underappreciated of the major points and miles currencies. Despite some negatives, Citi ThankYou points remain valuable, especially for those looking to book award flights on international carriers.

Having a premium Citi ThankYou card like the Citi Prestige Card or the Citi Strata Premier Card is important to maximize the Citi ThankYou Rewards program. These cards unlock transfers to all the Citi ThankYou partners at the best rate, which can provide many high-value award booking options.

]]>The move comes after TPG, last month, reported the Fort Worth-based carrier was trialing the new software at three airports.

With an audible beep, the program alerts gate agents when a passenger tries to board with an earlier group than the one on their boarding pass.

American’s gate agents will also get a visual alert, TPG has learned, and they’ll ask passengers boarding out of turn to return when their group is called.

If you’re flying with a companion who’s assigned to a higher boarding group, you’ll be allowed to board with them. You’ll likely hear the system’s alert sound indicating you’ve boarded too early — but the gate agent can override it with a quick click.

Boarding groups are big business

Why this focus from American?

“Boarding is really important to our customers,” said Kim Cisek, American’s vice president of customer experience.

Indeed, it may sound trivial, but boarding groups are a key part of American’s value proposition for its higher-tier tickets, for AAdvantage elite status, and for customers who carry a cobranded American credit card.

Certain credit cards — along with elite status and premium-cabin tickets — come with higher-priority boarding groups.

And an earlier boarding group generally means more access to overhead bin space.

“Our customers want a calm boarding experience, they want it to be seamless, they want to be able to board with their group and not have other customers in front of them,” Cisek said, speaking to TPG exclusively last month at the airline’s Texas headquarters.

Just how often were travelers hopping in line ahead of their assigned group?

“It was happening often enough that we knew this was something we wanted to pursue,” Cisek acknowledged.

Expanding early trials

American trialed the technology at Albuquerque International Sunport (ABQ) in New Mexico, Tucson International Airport (TUS) in Arizona, and Ronald Reagan Washington National Airport (DCA) in recent weeks. The airline also ran some tests, Cisek said, at its home base, Dallas Fort Worth International Airport (DFW).

On top of barring travelers from boarding out of turn, American reports it’s seen an added perk at airports where it’s tested the technology: The airline has noticed passengers are generally crowing around the boarding area less, Cisek said.

American has nine boarding groups. Travelers who don’t have elite status but join the AAdvantage loyalty program typically board in Group 6.

Related reading:

- Your ultimate guide to American Airlines AAdvantage

- Best credit cards for American Airlines flyers

- American Airlines elite status: What it is and how to earn it

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

- Everything you need to know about flying basic economy on American Airlines

Thanks to Marriott’s partnership with Uber, Marriott Bonvoy members can earn Marriott points on Uber Eats deliveries and select Uber rides. This can help you get closer to your next free hotel stay.

For those who haven’t yet taken advantage of this partnership, there’s a new promotion that lets you earn 750 bonus points by simply linking your Marriott Bonvoy and Uber accounts — no rides or food deliveries required. The process is as simple as linking your accounts with a few taps on your phone. Frequent Miler first shared the news.

Keep reading to find out how to snag these limited-time bonus points and how to earn points on autopilot whenever you use Uber or Uber Eats.

Related: Earn more points and miles with Uber, Lyft and Starbucks apps

Earn 750 Marriott points with this promotion

We’ve seen similar deals in the past that required linking your accounts and taking a ride, but this one is even easier. All you have to do is link your Marriott Bonvoy account to your Uber account in the Uber app by Nov. 27, and you’ll get 750 bonus Bonvoy points. This bonus is only available to members who are linking their accounts for the first time.

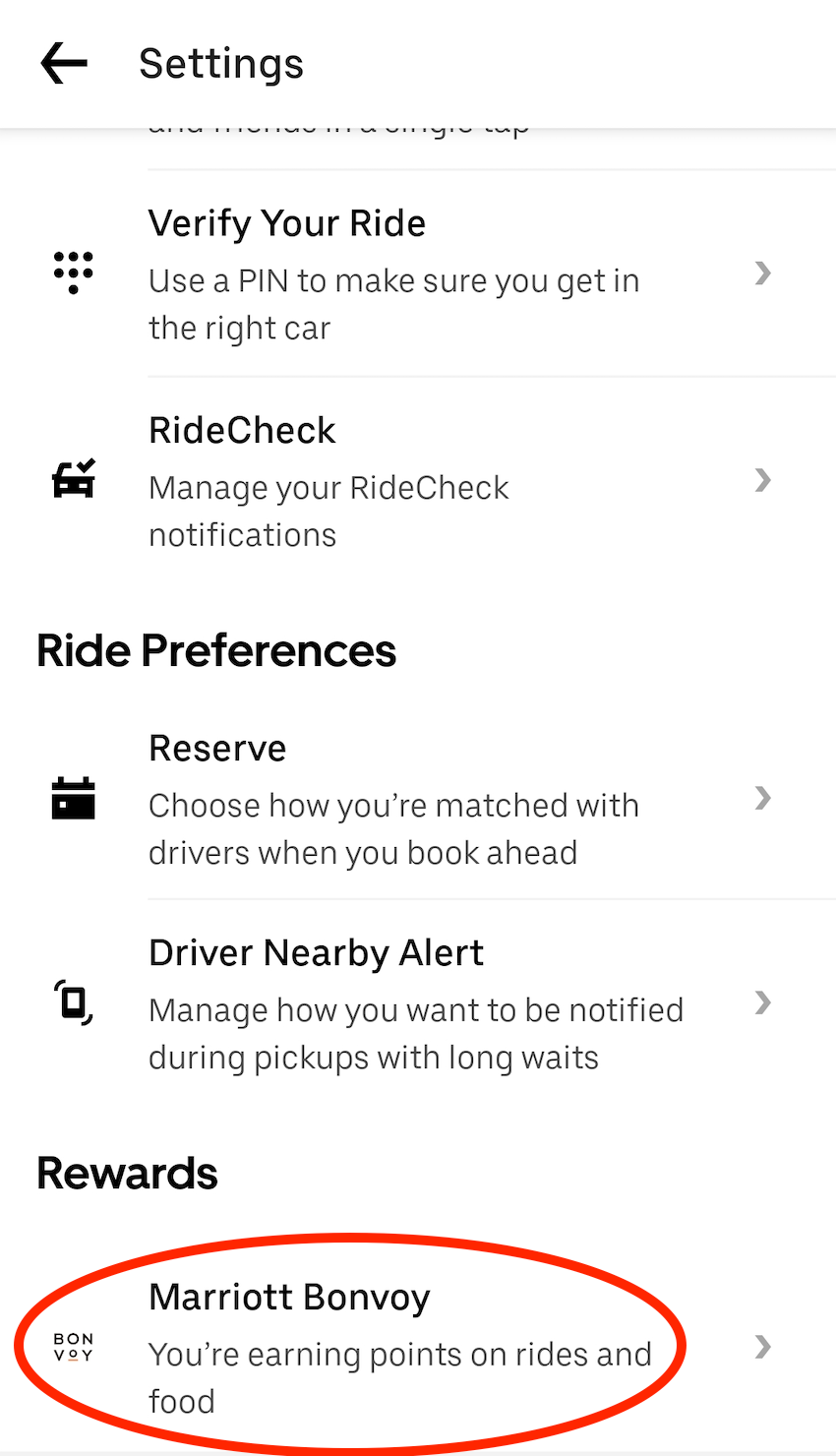

Linking your accounts is quick and easy:

- Open the Uber app and tap “Account” in the bottom right.

- Tap “Settings” and scroll down to tap “Marriott Bonvoy” under the “Rewards” section.

- Tap “Link Account” and log in to your?Marriott Bonvoy account.

Voila, that’s it! You’ll see the following confirmation at the bottom of your settings.

Getting the bonus isn’t quite as fast. According to the promotion page, your 750 bonus points may take four to six weeks to appear in your Marriott Bonvoy account.

Related: 29 best Marriott hotels in the world

Keep earning Marriott points on Uber rides and food delivery

Once your accounts are linked, you’ll not only earn 750 bonus points, but you’ll also continue earning points on qualifying Uber rides and Uber Eats orders.

You’ll earn points as follows:

- 2 points per dollar spent on U.S. UberX Reserve rides and 3 points per dollar spent on U.S. Uber Premium rides (includes UberXL, Uber Black, Uber SUV and Uber Comfort)

- 2 points per dollar spent on Uber Eats restaurant and grocery orders of $40 or more delivered to Residence Inn, TownePlace Suites and Element hotels in the U.S.

- 1 point per dollar spent on Uber Eats restaurant and grocery orders of $40 or more elsewhere in the U.S.

Marriott says it could take a few business days for Bonvoy points to post after eligible Uber rides and food deliveries. However, based on the TPG team’s experiences, the points typically post almost immediately.

If you want to maximize your rewards while still earning Marriott Bonvoy points, consider paying with a credit card that earns?bonus points or miles on Uber rides or?food delivery so you can effectively double dip.

Gabrielle Bernardini, TPG’s senior points and miles editor, maximizes her rewards by using The Platinum Card? from American Express, which offers Uber Cash — $15 each month, plus a $20 bonus in December — to use for Uber rides or Uber Eats in the U.S. (make sure your Amex Plat is added to the Uber account and you can redeem with any Amex card). She then earns 1 American Express Membership Rewards point per dollar spent beyond those credits, which TPG values at 2 cents apiece, according to our November 2024 valuations. This is in addition to bonus Marriott points.

Related: Baby on board: You can now book Uber with a car seat in 2 major cities

Bottom line

Since this promotion ends Nov. 27, now is a great time to link your Marriott and Uber accounts and earn 750 bonus Bonvoy points, even if you don’t plan to use Uber or Uber Eats anytime soon. All future qualifying rides and orders will earn you valuable Marriott Bonvoy points that you can redeem toward free nights.

]]>While mileage earning of AAdvantage miles and Loyalty Points between American and Dublin-based Aer Lingus was implemented in December 2023, new benefits are now available for elite members of American’s Advantage program when they fly with Aer Lingus and elite Aer Lingus AerClub members when they fly with American.

Keep reading to find out the details below.

Related: American Airlines elite status: What it is and how to earn it

AAdvantage elite members can enjoy perks when flying Aer Lingus

AAdvantage Gold members can enjoy the following new benefits when flying with Aer Lingus:

- 40% bonus miles (a total of 7 miles per dollar spent on base fares and carrier-imposed surcharges)

- Priority check-in

- Priority boarding

AAdvantage Platinum members can enjoy:

- 60% bonus miles (a total of 8 miles per dollar spent on base fares and carrier-imposed surcharges)

- Priority check-in

- Fast-track security

- Priority boarding

- Lounge access with one guest

- One additional checked bag in economy class

AAdvantage Platinum Pro members can enjoy:

- 80% bonus miles (a total of 9 miles per dollar spent on base fares and carrier-imposed surcharges)

- Priority check-in

- Fast-track security

- Priority boarding

- Lounge access with one guest

- One additional checked bag in all classes

AAdvantage Executive Platinum members can enjoy:

- 120% bonus miles (a total of 11 miles per dollar spent on base fares and carrier-imposed surcharges)

- Priority check-in

- Fast-track security

- Priority boarding

- Lounge access with one guest

- One additional checked bag in all classes

Aer Lingus is part of the International Airlines Group, which owns Oneworld partners British Airways and Iberia. From Dec. 2, 2024, AerClub elite members can also enjoy new benefits when flying with British Airways. Members will be notified of the exact benefits in the coming days, according to a press release from Aer Lingus.

Aer Lingus operates its own lounges at Dublin Airport (DUB) — including a new U.S. Preclearance lounge called 51st&Green — plus London’s Heathrow Airport (LHR) and New York City’s John F. Kennedy International Airport (JFK). It also allows eligible passengers to access American Airlines Flagship Lounges and Admirals Clubs at all U.S. locations when departing, connecting or arriving on Aer Lingus-operated flights.

The news follows recent expansions to Aer Lingus’ U.S. route network. With the delivery of the new Airbus A321XLR aircraft, the airline will launch nonstop service from Nashville International Airport (BNA) to DUB?four times per week from April 12, 2025, and from Indianapolis International Airport (IND) to DUB, also four times per week but from May 3, 2025.

The carrier will operate 24 transatlantic routes to North America and the Caribbean in 2025.

At this time, you cannot redeem AAdvantage miles to book award travel on Aer Lingus; however, American’s website states that this reciprocal perk is “coming soon.”

Bottom line

While the benefits of this airline partnership for travelers have been slow to materialize, it is great to see that elite members of American Airlines’ AAdvantage program can now enjoy various travel perks when flying Aer Lingus to Ireland or beyond.

If you hold elite status in the AAdvantage program, remember to add your membership number to your next Aer Lingus booking to take “advantage” of the new perks.

]]>Editor’s note: This is a recurring post, regularly updated with new information and offers.

If you’re looking to boost your travel with a nice haul of transferable points, you might want to think about one of Citi’s most viable cards on the market.

New Citi Strata Premier? Card?(see rates and fees) cardholders can earn 75,000 bonus points after spending $4,000 on purchases within the first three months of account opening.

According to TPG’s November 2024 valuations of ThankYou points at 1.8 cents apiece, that’s a bonus worth $1,350.

In the past, Citi has offered up to 80,000 ThankYou bonus points — and while that’s a pretty solid deal, 75,000 ThankYou points also offer tons of value. It’s worth noting this card underwent a very minor refresh in May; the annual fee stayed the same while some new benefits were introduced.

Let’s dive deeper into Citi’s Strata Premier Card to see what other perks it offers.

Earning points on the Strata Premier

Aside from the potential points haul the welcome bonus offers, the Citi Strata Premier is one of the best earners among rewards credit cards thanks to its various bonus categories. They include:

- 10 ThankYou points per dollar on hotels, car rentals and attractions when booked through CitiTravel.com

- 3 points per dollar at restaurants

- 3 points per dollar at supermarkets

- 3 points per dollar at gas stations and electric vehicle charging stations

- 3 points per dollar on air travel?and?hotels

- 1 point per dollar on all other purchases

What can you do with Citi ThankYou points?

What’s particularly valuable about ThankYou points is the ability to utilize the issuer’s 21 airline and hotel transfer partners.

After you meet the initial spending requirement of $4,000 in the first three months, you’ll have 75,000 ThankYou points — and many more if you’ve spent in the bonus categories listed above — that you can use to book travel that includes flights and hotels.

If you value simplicity, the 75,000-point welcome bonus will let you book $750 of paid travel directly through the Citi ThankYou travel portal.

You’ll earn miles and elite status on these flights by redeeming points this way, and you don’t have to worry about award availability. You could also redeem your points for $750 in gift cards.

TPG credit cards writer Danyal Ahmed is a huge fan of the Citi Strata Premier and utilizes his points exclusively by transferring them to some of Citi’s transfer partners.

He finds value in programs such as Air France-KLM Flying Blue, thanks to their standardized award chart between the U.S. and Europe. It offers business-class tickets for 50,000 points one-way, with the ability to add a free stopover.

Danyal also often transfers his Citi ThankYou points to Qatar Airways Privilege Club to book their renowned Qsuite business-class product.

Related:?Everything you need to know about ThankYou points

Things to consider

Here’s the specific verbiage on application restrictions for this offer:

Bonus ThankYou? Points are not available if you have received a new account bonus for a Citi Premier? or a Citi Strata Premier? account in the past 48 months.

Additional perks offered by the Citi Strata Premier include:

- $100 annual hotel credit (on single hotel stay bookings of $500 or more, excluding taxes and fees, booked through CitiTravel.com or by calling 1-833-737-1288)

- Free FICO credit score monitoring

- Citi Quick Lock so you can block new purchases without interrupting recurring ones

- Lost wallet protection for emergency cash

- Citi Concierge access

- Complimentary ShopRunner membership

- No foreign transaction fees

- Citi Entertainment

- Extended warranty on purchases

The card also offers the following travel protections:

- Trip cancellation and interruption protection

- Trip delay protection

- Lost or damaged luggage insurance

- Car rental coverage

Bottom line

Between the welcome bonus, extra points earned through the ThankYou portal, earning 3 points per dollar on a wide range of popular bonus categories and valuable transfer partners, the Citi Strata Premier Card is a great travel rewards credit card.

You can easily rack up ThankYou points through everyday spending on gas, EV charging, groceries and dining purchases without a cap on how many points you can earn.

To learn more, read our full review of the Citi Strata Premier Card.

Apply here: Citi Strata Premier

Related: Better together: Why the Citi Strata Premier and Rewards+ cards are a great pair

]]>While tens of thousands line up to see the parade in person or watch the balloons get blown up on the Upper West Side the day before, you don’t need to go outside to see some of the new balloons and floats.

TPG got a special preview.

This year’s parade features more than 5,000 volunteers, 34 floats, 22 giant character balloons, seven of what Macy’s calls “balloonicles,” 11 marching bands and 28 clown crews. That’s not to mention the musical stars, Broadway performances and, of course, Santa Claus, which will all flow from Central Park West to Macy’s home base at West 34th Street and Sixth Avenue.

Here’s what you can expect to see next week.

New Macy’s Thanksgiving Day Parade floats and balloons

Gabby — the star of the hugely popular “Gabby’s Dollhouse” series from DreamWorks Animation —? will make her parade debut this year. The Gabby balloon is painted with more than 25 colors, and a new movie starring Gabby and her famous cat Pandy Paws will be coming in 2025.

Related:?Holiday airfare is rising: What to know if you haven’t booked yet

There are several other new balloons and floats for 2024, including Spider-Man; Marshall from “Paw Patrol;” a newly designed Goku, the legendary hero of the “Dragon Ball” franchise; and Santa’s magical arctic fox Extraordinary Noorah, joined by The Elf on the Shelf.

Here are a few more.

Dora’s Fantastical Rainforest by Nickelodeon

Dora the Explorer is back for the first time in 15 years. “Exciting discoveries await Dora & her best friend Boots” as she returns to the parade, Macy’s said. “Accompanied by her reliable map & back pack, Dora is prepared to navigate the tropical terrain & New York City streets while keeping her eyes & ears peeled for Swiper the mischievous fox.”

Pasta Knight by Rao’s Homemade

This year, a cool dragon represents the famous New York restaurant Rao’s and its Rao’s Homemade brand of pastas and sauces.

The Rao’s Homemade Pasta Knight is here to slay a hunger dragon, with a backdrop designed to resemble a village in Southern Italy. Macy’s said it was inspired by the origin of Rao’s Homemade authentic Italian marinara sauce. Look closely, and you’ll see the knight is made from pasta shapes like orecchiette, fusilli and rigatoni, among others.

Wondrous World of Wildlife by the Bronx Zoo

My favorite float was the Wondrous World of Wildlife entry from the Bronx Zoo right here in New York City. This famous park has been amazing visitors for the past 125 years. “From Amur tigers to western lowland gorillas to giraffes, these are just some of the extraordinary creatures you can encounter on your next visit to the Bronx Zoo,” according to Macy’s.

Each animal on the float was designed to be the same size as its real-life counterpart. During the actual parade, Idina Menzel will perform on the float.

Magic Meets the Seas by Disney Cruise Line

The Magic Meets the Seas float from Disney Cruise Line features unique design details from eight of the Disney Cruise Line ships. Take a look at the fun character art adorning the bows.

Strikes Again by Go Bowling

This fully kinetic “balloonicle,” powered by an electric battery, features the Go Bowling Bowler, who resembles an animatronic character straight out of a theme park. This is a fun new addition to the lineup.

Related:?Your guide to the can’t-miss holiday happenings in New York City

Wednesday’s Feast by Netflix

They’re creepy and they’re kooky, mysterious and spooky. They’re altogether ooky. They’re the Addams family, and they will be represented by Wednesday and Pugsley Addams in the parade thanks to a cool float sponsored by Netflix. The Macy’s Studios team said it spent over 100 hours meticulously sculpting the faces of the “Addams Family” characters for the parade.

Minnie Mouse

For the first time in parade history, Disney’s Minnie Mouse will be strolling the streets of New York City in her iconic polka-dot bow and signature yellow pumps. Minnie is five stories tall — that’s 60 feet tall and 60 feet long.

Candy Cosmos by Haribo

Haribo makes delicious gummies, and they make cute parade floats and balloons, too. The company has more than 25 gummies products on the market. Can you name all the types shown on its float?

Bottom line

Hopefully, our preview of the Macy’s Thanksgiving Day Parade made you want to attend in real life at some point. We have a complete guide to everything you need to know to plan a trip and see the balloons in person.

Related reading:

]]>Senate Bill 1838 would require credit card-issuing banks to offer a minimum of two networks for merchants processing electronic credit card transactions, prohibiting Visa and Mastercard from acting as a duopoly as the largest market share of cards. The bill claims forced competition would lower fees charged by merchants for consumers using their credit cards.

Sens. Roger Marshall, R-Kan, and Richard Durbin, D-Ill., introduced the bipartisan legislation in 2022 before reintroducing it with additional support in 2023, including from Vice President-elect J.D. Vance. Despite momentum from high-profile public support, including from President-elect Donald Trump, the bill has largely remained stalled for most of 2023 and 2024 thus far.

The lack of movement beyond its introduction did not stop the Senate Judiciary Committee from holding its final hearing on the bill this year. During the hearing, members largely urged Visa and Mastercard to modify their practices prior to congressional action.

Sen. Thom Tillis, R-N.C., reiterated his belief that the bill would not pass in this Congress. He suggested that the bill would actually “create more problems.” However, he urged the two credit card operators to act on their own before congressional intervention.

“The solution coming from Congress will not be good for anyone,” he said on Tuesday.

Tillis had support from Sen. Josh Hawley, R-Mo., who has garnered a reputation for being among the most outspoken members of Congress, despite being a junior senator.

“This is not a sustainable solution,” he said. “I am here to tell you this will not stand.”

Hawley was the only member who offered an alternative to the bill. He piggybacked on previous proposals, including those by both himself and Trump, to require credit card companies to cap interest rates to lower the $1.14 trillion debt among American credit card users. Reporting on those efforts, which have also been proposed by Democrats, suggests that the credit card industry would similarly oppose that legislation in the way it has with the Credit Card Competition Act.

If the Credit Card Competition Act were currently up for a vote, Louisiana Republican Sen. John Kennedy said he “didn’t know how he would vote,” but that Congress would act in some form or fashion … eventually.

Kennedy directly addressed Visa and Mastercard representatives at the hearing and said there were two possible outcomes.

“When we are done with you, you could end up looking like either the post office or the Dallas Cowboys,” he said. His office did not respond to a request for comment by the time of publication seeking clarification on his statement.

Critics, including Airlines for America, warn that the bill would negatively affect loyalty programs, such as those offered by cobranded credit cards.

Airlines for America is a trade group representing major North American airlines such as United Airlines, American Airlines and Delta Air Lines. It launched an anti-legislation campaign highlighting this concern called Protect Our Points. (TPG is among the many organizations with a vested interest in this cause and launched its own campaign, Protect Your Points. The campaign is in collaboration with the Electronic Payments Coalition, which advocates for credit unions, community banks, payment card networks and other banking institutions involved in the electronic payment process.)

“This hearing was so blatantly biased and one-sided, it practically needed a disclaimer saying it was bought, paid for, and sponsored by the campaign donations of the nation’s largest corporate mega-stores,” Electronic Payments Coalition executive chairman Richard Hunt said in a statement following the hearing.

In response to the bill’s claims that competition would lower fees for consumers and small businesses, the group pointed to a Congressional Research Service report. The report concludes that the bill is “unlikely to lower prices for consumers or help small businesses,” citing a lack of evidence that credit card routing mandates yield savings for consumers.

Financial industry critics of the bill routinely reference the Durbin Amendment, which established a fixed fee on debit card transaction processing in lieu of a percentage fee based on the total transaction. The Durbin Amendment is largely blamed for limiting rewards banks offered for debit card purchases and, therefore, terminating most debit card perks for consumers.

If history is any precedent, credit card loyalty programs could falter in the same way. If frequent flyer programs are curtailed, travelers could see airlines respond to a revenue loss by raising costs for travelers, such as the price of airfare.

“It turns out that most of the airlines make more money on the credit card branded cards and frequent flyer programs than they do on airline operations,” Durbin noted. “This legislation scares the living hell out of them.”

Various tourism industry stakeholders oppose the bill, warning it could negatively impact state tourism.

“If signed into law, this bill could suppress travel and tourism by eliminating the foundation of credit card rewards and loyalty programs that countless visitors to Florida — as well as Floridians — rely on to travel,” nine Miami-area stakeholders wrote in a letter to Republican Florida Sens. Marco Rubio and Rick Scott, which was shared with TPG. These stakeholders include the Greater Miami Convention & Visitors Bureau, Greater Miami & the Beaches Hotel Association and the Greater Miami LGBTQ Chamber of Commerce.

Proponents say the proposed legislation will improve competition within credit card exchanges, as Visa and Mastercard account for a large proportion of general-purpose credit cards.

On Nov. 18, the American Bankers Association spearheaded an opposition letter to chairman Durbin and ranking member Lindsey Graham, a South Carolina Republican. According to the letter, the bill would “open the door to fraud, hamper rewards programs, and limit the allocation of credit to individuals and small businesses.”

In contrast, Sen. Peter Welch, D-Vt., said Visa and Mastercard fees are “killing small businesses in America” at the hearing, despite small businesses relying on Visa and Mastercard to process payments.

The European Union capped interchange fees in 2015 at 0.2% of the transaction value for consumer debit cards and 0.3% for Visa and Mastercard consumer credit cards. Bill Sheedy, senior adviser to the CEO of Visa, said this resulted in the majority of the loyalty programs being eliminated or greatly devalued.

“Those changes were bad for European consumers due to higher fees and thus fewer rewards,” he said. Indeed, the credit card rewards landscape in Europe is much smaller than in the United States. Europeans have access to very few high-value sign-up bonus credit cards or charge cards.

Bottom line

As of Nov. 20, the Credit Card Competition Act has yet to progress beyond committee discussion. Based on Tuesday’s Senate Judiciary Committee hearing, this bill is not likely to pass this congressional session.

In the interim, bill supporters urged Visa and Mastercard to pursue a path of modification outside of a congressional mandate.

“The most liberal and conservative members agree we have to do something about this,” Durbin said. “What the hell is going on here?”

It’s worth noting that Durbin is up for reelection in 2026, and he has not confirmed whether he will be seeking it. Even if he retires, the bill appears to have enough bipartisan support to remain relevant.

Related reading:

]]>Editor’s Note: JW Marriott Phoenix Desert Ridge Resort & Spa provided a complimentary stay so that TPG could get an inside look at the hotel and its amenities. The opinions expressed below are entirely those of the author and weren’t subject to review by Marriott, the hotel or any other external entity.

Luxury resorts are commonplace in the Phoenix area, but the JW Marriott Phoenix Desert Ridge Resort & Spa is anything but common. The resort boasts two championship golf courses, one of the city’s premier pickleball facilities, two restaurants helmed by a “Top Chef” alum, a recently renovated 140,000-square-foot water park, a world-class spa and so much more.

With such a breadth of activities and amenities, the JW Marriott Phoenix Desert Ridge Resort & Spa can just as easily play host to your next family vacation as it can to a romantic getaway or an action-packed weekend of hiking, biking and golfing.

Here’s everything you need to know before booking your stay at the JW Marriott Phoenix Desert Ridge Resort & Spa.

What is the JW Marriott Phoenix Desert Ridge Resort & Spa?

With its earth-toned hues, ample natural lighting and artwork inspired by Mother Earth, the understated decor and color scheme of the JW Marriott Phoenix Desert Ridge reflects the green cacti, sandy desert and clear blue skies that guests will find outside the hotel’s front doors.

This is a true resort property, with enough activities, dining and amenities so that you can have just as much fun exploring the resort as you would exploring the Phoenix/Scottsdale area. Families can start their day by feeding the fish, turtles and hummingbirds who call the resort home before splashing all afternoon at the AquaRidge WaterPark. Those traveling without little ones in tow can spend the morning golfing (after grabbing a coffee from the on-site Starbucks, of course) before heading to the adults-only Sky Island pool to relax.

The property is a member of the Marriott family, so you can earn and redeem Marriott Bonvoy points when you stay — the icing on top.

How to book the JW Marriott Phoenix Desert Ridge Resort & Spa

It’s best to book your stay at this resort directly through Marriott for the best rates and points redemptions. This ensures that you can earn Marriott Bonvoy points on paid stays and benefit from the perks of Marriott Bonvoy’s elite status.

Standard room rates start at $354 per night if you visit in the hot summer months, and average closer to the $500 to $700 range during the rest of the year. The room rate includes a $55 per night resort fee, which covers the following:

- Enhanced high-speed internet and local calls

- Daily pickleball or tennis for up to two people (includes paddles or racquets and one hour of court time based on availability)

- Daily access to Wildfire Golf Driving Range for up to two people with unlimited balls and use of clubs (proper golf attire required)

- Daily bike rentals for up to two people for up to two hours

Marriott Bonvoy point redemptions start at 41,000 points per night. According to TPG’s November 2024 valuations, those points are worth $348.50. The equivalent cash price listed by Marriott on a 41,000-point night is $587, making this a great points redemption.

Additionally, since the hotel is part of Amex Fine Hotels + Resorts, those holding?The Platinum Card? from American Express?or?The Business Platinum Card? from American Express?can book via FHR to receive elitelike perks such as upgrades (based on availability), up to a $100 credit to use on-property, complimentary daily breakfast for two and guaranteed late checkout.

When booking the JW Marriott Phoenix Desert Ridge, you’ll want to use one of the credit cards that earn the most points for Marriott stays, as well as one that possibly offers automatic Marriott Bonvoy elite status for value-added benefits. These include:

- Marriott Bonvoy Brilliant? American Express? Card: Earn 6 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program; automatic Platinum Elite status; and 25 elite night credits per year toward a higher tier.

- Marriott Bonvoy Bevy? American Express? Card: Earn 6 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program; automatic Gold Elite status; and 15 elite night credits per year toward a higher tier.

- Marriott Bonvoy Bountiful Card: Earn 6 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program; automatic Gold Elite status; and 15 elite night credits per year toward a higher tier.

- Marriott Bonvoy Business? American Express? Card: Earn 6 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program; automatic Gold Elite status; and 15 elite night credits per year toward a higher tier.

- Marriott Bonvoy Boundless? Credit Card: Earn 6 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program; automatic Silver Elite status; and 15 elite night credits per year toward a higher tier.

- Marriott Bonvoy Bold? Credit Card: Earn 3 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program; automatic Silver Elite status; and 5 elite night credits per year toward a higher tier.

The information for the Marriott Bonvoy Bountiful card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The location is quiet yet convenient

The resort is located in north Phoenix, about a 30-minute drive from Phoenix Sky Harbor International Airport (PHX). From the resort, you can reach many popular local attractions in under 30 minutes, including Old Town Scottsdale, Camelback Mountain, the Phoenix Mountains Preserve and the Phoenix Zoo.

Despite being close to several restaurants, shopping centers and attractions, the resort is set back about a quarter-mile off the main road. This keeps the location convenient but also quiet, with unspoiled views of the surrounding desert. From my balcony, all I saw were mountain vistas and blazing sunrises.

Rooms feel tranquil with earth-toned decor and modern amenities

The JW Marriott Phoenix Desert Ridge has several room categories to choose from, including standard one-king or two-queen rooms with resort, mountain or pool views; patio rooms with fire pits; studio suites with Murphy beds and sofa beds; wellness suites with yoga nooks or Peloton bikes; and one-bedroom suites.

We were in a one-bedroom suite that had a sofa bed, sitting area, desk and large TV in the living room and a king-size bed and second TV in the bedroom. The beds were soft and comfortable, with bedding that wasn’t so heavy you’d feel overheated with the warm outdoor temperatures.

There were storage cabinets in the bedroom and the bathroom, giving my family of five plenty of space to hide away our luggage and souvenirs we picked up along the way.

The living room also had a minifridge and coffee maker with Illy espresso pods.

Upon entering the room, there is a short hallway with a bench and a closet that holds an iron and ironing board, robes, hangers, a laundry bag and a scale. This hallway leads to the bathroom, which is one of the largest hotel bathrooms I’ve seen — even in a suite of this size.

The first section of the bathroom had a double vanity with a few handy additions to the standard amenity lineup, including facial wipes and mouthwash. A door separated the vanity from the rest of the bathroom, which included a stand-alone shower, a toilet and a large soaking tub. Sitting atop the tub was a small tray with slippers, bath salts, facial soap and body wash.

The bathroom was stocked with Aromatherapy Associates Balance scented products, which had relaxing notes of lavender and ylang-ylang.

My favorite part of the room wasn’t inside the room at all, but rather the spacious furnished balcony outside of our room (and every room at the resort). I started each day here with a hot cup of espresso and watched the sun rise slowly over the Sonoran Desert.

Some rooms come with exclusive club access

Our room also came with access to the hotel’s exclusive JW Griffin Club. The Griffin Club is open for breakfast, lunch and evening hors d’oeuvres. It also has coffee, tea and juices and a bar with beer, wine and spirits, plus snacks, sodas and water that you can grab at any time.

You can purchase access to the club for an add-on fee of $150 per day for adults and $50 for children or book a room that includes access. These rooms run about $200 per night more than standard rooms and include Griffin Club access for two people.

Not one, but two restaurants helmed by a celebrity chef

The restaurant scene at the JW Marriott Desert Ridge has gotten a major overhaul in recent years, with two concepts from acclaimed “Top Chef” alum Angelo Sosa.

Tia Carmen

Tia Carmen opened in 2022. Both the name (which translates to Aunt Carmen) and the menu are inspired by chef Sosa’s aunt, with a menu of fresh Southwestern flavors in a light, airy setting that felt as inviting as you would expect the kitchen of the aunt who loves cooking for everyone to feel.

Standout dishes here include the pan frito with honey butter ($14), the tuna crudo in a corn coconut broth ($23) and the chicken guisado with turmeric rice ($34). The latter I felt obligated to try, because it is based on Tia Carmen’s own recipe.

My kids weren’t as excited for the Dominican stew as I was, but the restaurant luckily has a dedicated kids menu with fallback fare like chicken fingers and fries.

Kembara

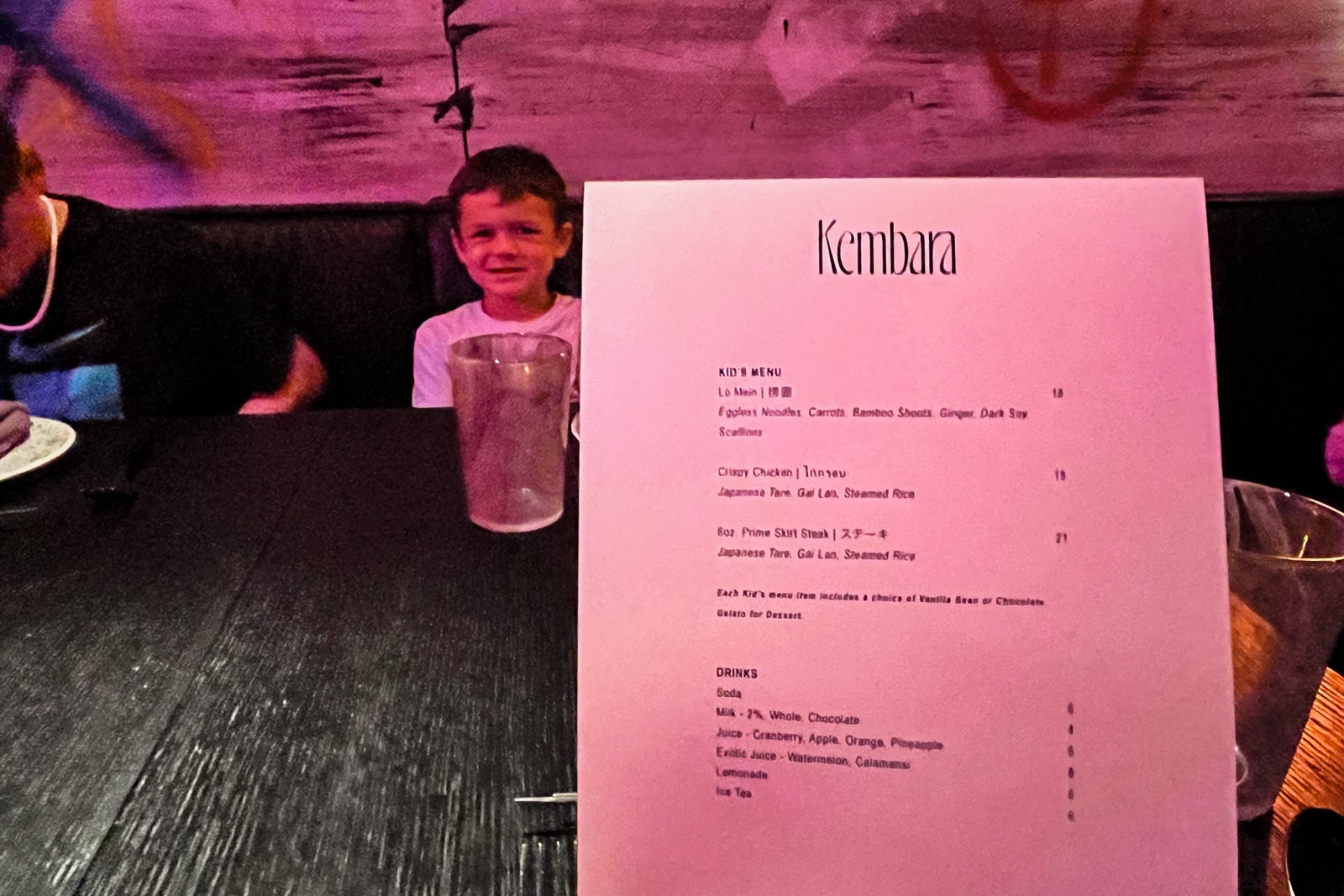

Open since December 2023, Kembara is chef Sosa’s most recent addition to the resort. Consider it the Asian-inspired, edgy counterpart to Tia Carmen’s warm, inviting atmosphere (it is worth mentioning that the service was exceedingly friendly at both).

The decor at this restaurant was much darker, with graffiti on the walls and pink neon lights strung across the ceiling. Most dishes were designed to be shared, so we sampled a little bit of everything. Our favorites included the tuna Thai jewel in a lemongrass-ginger broth ($23), steamed pork dumplings ($14) and lamb spring rolls ($18).

My kids were equally impressed with their meals, which were served in bento boxes and came with chicken, fruit, cucumbers and rice. What I think they liked even more, though, was that the kids menu came with a piece of paper and instructions for making an origami bird.

Other dining options

Guests can also dine at Twenty6, a lobby lounge serving American fare along with beer, wine and cocktails; at Meritage next to the Wildfire Golf Club; or at the Just a Splash Bar & Grill at the AquaRidge WaterPark.

The on-site Starbucks is also open from morning until late afternoon for coffee or grab-and-go items.

There are plenty of on-property activities (both energizing and relaxing)

One of our biggest takeaways was that JW Marriott Desert Ridge really does have so much to keep guests busy during a visit.

In addition to at-your-leisure activities like yard games on the large outdoor lawn, a 24-hour fitness center, bike rentals, and walking or jogging paths are available (the hotel also provides maps for area hikes). The property also boasts both pickleball and tennis courts (including group and private instruction), fitness classes and personal training available for an additional fee.

The hotel also provides a rotating monthly schedule of activities, some complimentary and some for a fee. During our visit, we fed fish, turtles and hummingbirds, and there are also weekly wellness walks around the property, sound bath experiences, horticulture tours, arts and crafts and more.

Several of the kid-friendly activities take place at the Family Escape kids club. Day care is available for kids ages 4 to 12 for a fee, but they also have daily family activities like craft time and movie nights, which are complimentary.

Treatments at the full-service Revive Spa include everything from massage, cupping and reflexology to facials, body scrubs and wraps. Spa services included access to the complex’s pool, cabanas, sauna, steam rooms, bistro and salon.

To give you an idea of pricing, a 50-minute massage starts at $209, a 50-minute facial starts from $214 and a 50-minute full-body magnesium detox wrap starts from $224.

The Wildfire Golf Club’s two courses were designed by PGA legends Arnold Palmer and Nick Faldo. Guests can reserve a tee time at either course or sign up for lessons. Rental clubs are also available if you don’t want to lug yours to the airport.

There is a full water park for splashing, sliding and sunbathing

Of everything on offer at the JW Marriott Phoenix Desert Ridge, we spent the majority of our time at the AquaRidge WaterPark. Most of the 140,000-square-foot water park was part of a resort-wide $80 million transformation in 2023, $18 million of which went toward expanding the water park.

AquaRidge is home to several sections designed to let you swim and sunbathe however you prefer. If you want family-friendly fun like wild waterslides, a splash pad and a meandering lazy river, head for the Havasu Playground area.

This is where we spent most of our time. On the day when we had a full afternoon to swim, we set up shop in one of the resort’s cabanas. Our cabana had a fan with a mister to keep us cool, a refrigerator and safe, towels, water pitchers and ice and ample seating in both the sun and the shade. We also had a server who delivered food and drinks from the nearby Just a Splash dining outlet.

If you prefer a quieter spot to swim away from the splashes and squeals of the kiddos, head for one of the pools and the hot tub in the Sedona Springs and Sedona Cove areas. These are not limited to adults only, but during our visit, they definitely had a more relaxing vibe than Havasu Playground.

For the true luxury of not seeing or hearing a single child, you’ll need to reserve paid access to the resort’s 21-and-older Sky Island pool complex. This area has a pool and a hot tub, with the option of daybeds, chaise lounges or cabanas for seating.

Accessibility

The JW Marriott Desert Ridge has several accessible guest rooms with features like widened doors for wheelchair access, roll-in showers and hearing or visual assistance devices.

The resort’s public areas are also wheelchair accessible, including wheelchair-friendly elevators, wheelchair lifts at the pool, convenient ramps and more.

Checking out

With comfortable rooms, family-friendly activities, an impressive new water park and mouthwatering restaurant menus, the JW Marriott Desert Ridge Resort & Spa was an ideal location for our time in Arizona. I wouldn’t hesitate to return to this property if our travels bring us back to the Phoenix/Scottsdale area.

Even when traveling without children, this resort can pull double duty as a relaxing getaway for grown-ups, thanks to its adults-only spaces and more sophisticated offerings (though I would recommend even adults take on the JW Marriott Desert Ridge’s thrilling waterslides … you’re never too old for a water slide).

Related reading:

]]>