Black Friday and Cyber Monday sales are almost upon us, and if you’re anything like us, you likely already have a few items on your Amazon watch list. While the actual sales are yet to officially begin, we’re already seeing a smattering of price drops across various items on Amazon and other retailers (not to mention, some great early hotel deals).

After Amazon Prime Day, the Black Friday and Cyber Monday sales are some of the best ways to save money on everything from headphones to household staples. Whether you are gearing up to save some cash during the sales or looking for deals on any of the other days of the year, here are ways you may be able to save money on your next Amazon “add to cart” moment.

Use points

After filling your Amazon cart, you might have noticed the “Shop with Points” option at checkout. This is not always the best use of your credit card points from a monetary value perspective, as you can often get better value from your points when redeeming for travel.

Sometimes, though, promotions award money off your Amazon order even when using a small number of points.

At any given time, various targeted American Express offers give cardholders the opportunity to save. In the past, TPG staffers with eligible American Express cards have been targeted to save between 10% and 40% on Amazon orders using as few as 1 American Express Membership Rewards point. Offer terms vary, but the concept remains relatively the same. If one of these offers is available for your account, it can be a great way to save on your next Amazon order.

To be eligible, you must link your eligible Amex card(s) to your Amazon account to shop with Membership Rewards points.

We regularly check for new offers. If you haven’t already, we suggest you do the same to make sure you’re not already eligible for an offer. Bookmark any offers pages to check again later if you’re not eligible right now.

Related: Save up to 50% on Amazon purchases using just 1 Amex point

Earn bonus points with the right credit card

If you have an American Express card, see if you’ve been targeted for any Amex Offers. These offers vary from account to account and can be a great way to rack up bonus Membership Rewards points or save money on purchases you would make anyway.

Amazon periodically appears in Amex Offers.

The trick here is to check your Amex account frequently to see if you’re eligible to earn bonus points or additional savings. You must manually add these offers to your Amex account and then use that card to pay for your Amazon orders.

TPG’s November 2024 valuations peg Amex Membership Rewards points at 2 cents each, so getting 5 points per dollar spent at Amazon is like earning 10 cents in rewards per dollar spent. To start accessing these Amex Offers, a couple of good American Express cards to consider that don’t even come with annual fees are:

- Blue Cash Everyday? Card from American Express (see rates and fees)

- Hilton Honors American Express Card (see rates and fees)

Use an Amazon credit card

While we’re discussing the best credit cards for Amazon purchases, let’s talk about Amazon’s own card: the Prime Visa.

It doesn’t have an annual fee, and new cardholders will receive a $200 Amazon gift card immediately upon approval. You can use the gift card straight away for sale purchases. The card is only available to Prime members, so factor that in when deciding if it is the right match for you.

The card usually awards 5% cash back at Amazon and Whole Foods Market; 2% cash back on restaurant, gas station, and local transit and commuting purchases; and 1% cash back on everything else.

Related: Prime Visa card review: A good choice for regular Amazon shoppers

Use coupons

This tip won’t come as a surprise, but if you see a coupon available on Amazon, be sure to click on it.

You’ll know if there’s a coupon available for your item, as there will be an icon that says “Coupon” below the price. The coupon will be activated if you check the box next to it. Coupons are sometimes only for a few cents or dollars, but saving money is saving money.

Some items will also let you save by subscribing for repeat deliveries.

Track prices and set price alerts

It’s hard to know just how good a sale is if you haven’t been pricing a certain item for a while. One site that can tell you the historical price of an item on Amazon — and even alert you to price drops — is CamelCamelCamel.

This website can help you gauge just how good a sale is. If it’s not an urgent purchase, you can also use this site to help you decide whether or not to hold off on buying an item until you get a better price through a sale or price drop.

Get credit for no-rush shipping or pickup

If you have time to spare, you can opt for no-rush shipping on your items and save them for an “Amazon Day Delivery.” This way, you’ll earn a credit that you can use for future digital purchases such as select e-books, music, videos and apps. The amount of the credit varies, but, based on my tests, it often totals up to a couple of dollars.

You’ll find this option during checkout when you’re prompted to enter your shipping information.

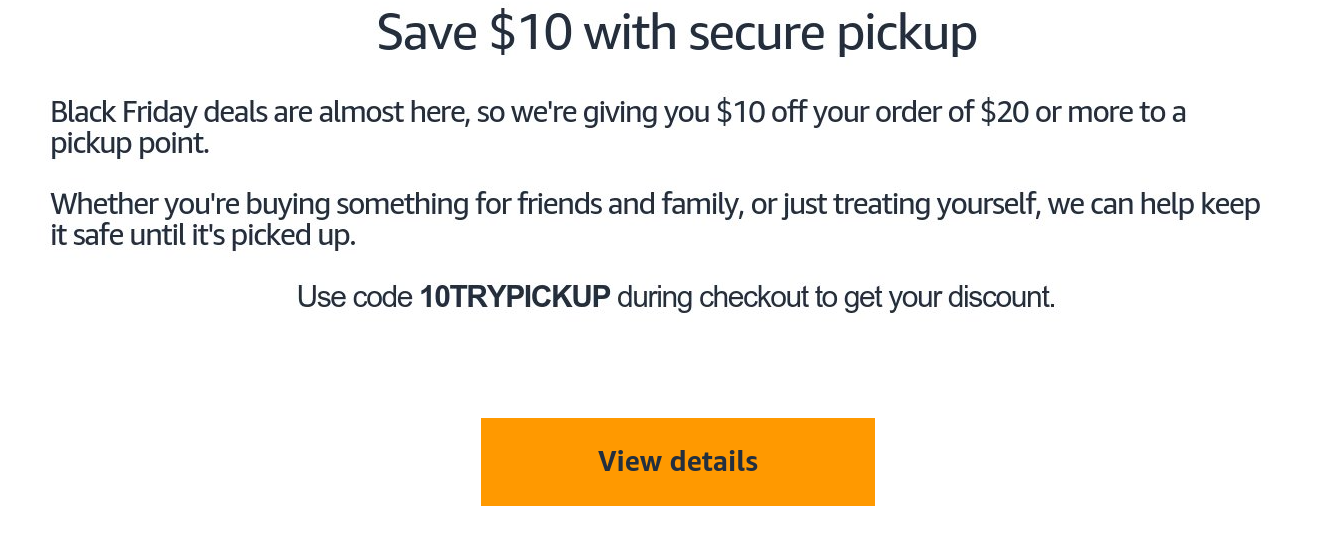

If you decide to send your order to an Amazon pickup point (rather than your home), you may be rewarded with a promotion. In the past, we’ve seen $10 credits on future $20 Amazon orders by using a code and retrieving orders at an Amazon Hub, such as an Amazon Locker or Locker+.

Sign up for a free Amazon Prime trial

If you’re not already an Amazon Prime member, you might be able to sign up for a free 30-day trial of Amazon Prime. It’s a great, free way to try out the service if you haven’t already. You’ll be able to receive free, two-day shipping on eligible items and also get access to Prime Video. After that, if you don’t cancel, the plan increases to $14.99 every month.

Purchase Amazon gift cards

If the credit cards in your wallet don’t offer any points or cash-back bonuses for Amazon, you can also purchase Amazon gift cards at grocery stores with a credit card that gives bonus rewards at that specific retailer.

For example, if you buy a $100 Amazon gift card at the grocery store and pay for that purchase with the Blue Cash Preferred? Card from American Express, you can earn 6% cash back on that purchase (on up to $6,000 per year in purchases at U.S. supermarkets, then 1%). Cash back is received as Reward Dollars that can be redeemed as a statement credit or at amazon.com checkout.

Bottom line

From having the right credit card to using American Express Reward Dollars for purchases, there are several ways to save money while shopping at Amazon. Bookmark this page for the upcoming Black Friday and Cyber Monday sales and beyond.

Related reading:

- Amex Blue Cash Preferred card review: Generous bonus categories and a solid welcome offer

- How to redeem your points and miles for Amazon purchases

- The do’s and don’ts on how to maximize your holiday purchases

- Earn bonus points and miles: How to maximize shopping portals for Black Friday and holiday deals

For rates and fees of the Blue Cash Everyday, click here.

For rates and fees of the Hilton Honors Amex, click here.

One of our favorite online shopping portals here at TPG is back with a new offer — and the deal makes it even easier to save money this holiday season.

Starting today, if you join Rakuten and spend at least $40 at eligible retailers within your first 90 days, you’ll earn a one-time bonus of $40. This includes a wide variety of popular merchants, including Walmart, Target, Saks Fifth Avenue and Lowe’s.

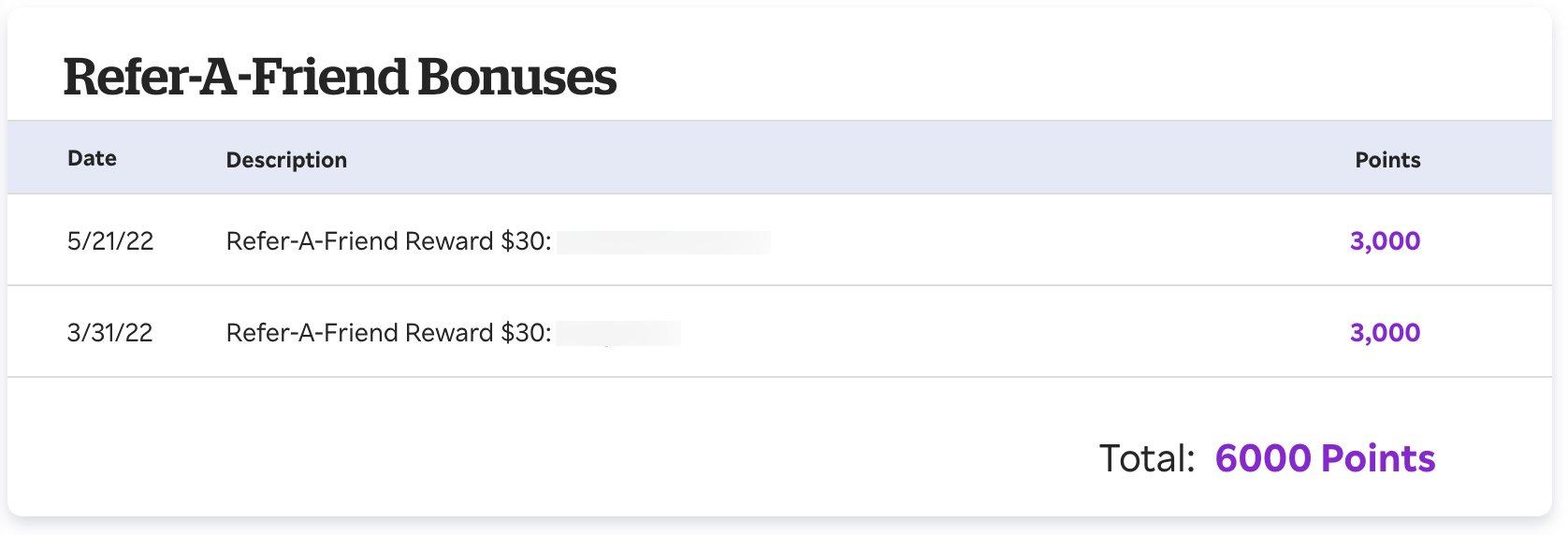

And if you’re already a Rakuten member, you can snag your own referral bonus for your friends. All you have to do is send them your personal referral link and make sure they use it to sign up. Then, when they spend at least $40 in 90 days, you’ll both take home a one-time bonus of $40.

In the past, we’ve seen similar referral bonuses of $30, as well as a bonus of 10% back for the first seven days — which required significantly more spending to earn $30. Joining without a referral usually only gets you a one-time bonus of $10. This new flat-rate, one-time $40 bonus is one of the best we’ve ever seen at Rakuten, and it’s a great opportunity to earn some extra cash back as you plan your holiday shopping.

Read more: How to earn bonus cash back or Amex points on your online shopping purchases with Rakuten

Overview of Rakuten

In case you’re unfamiliar with the site, Rakuten is an online shopping portal. It partners with hundreds of online retailers, from household brands like Target and Nike to smaller merchants like Gorjana. By starting your purchase at Rakuten and clicking through to the merchant from there, you’ll take home cash back on every eligible purchase you make — in addition to earnings on the credit card you use for the purchase.

You can even download the Rakuten plug-in to make things easier. Once this is installed, go directly to the merchant’s site. The browser extension will then notify you if there’s a rebate available — like this example at Macy’s (cash-back rate may have changed):

This friendly reminder simplifies earning more rewards for your online shopping.

You may wonder how all of this is possible. Rakuten makes marketing agreements with individual retailers, which pay the site commissions on purchases that begin there. Rakuten then passes a portion of those commissions on to the customer. The retailer gets additional business, and you and Rakuten enjoy a cut of those purchases — a win-win for all parties.

To join as a new member, visit this link and complete the online prompts.

To refer a friend, simply log into your Rakuten account and click the “Refer & Earn” button along the top row. You can choose to send your friend an email or share your referral link by another route.

How to make the most of Rakuten

While Rakuten is advertised as a cash-back portal, you can take your rewards to the next level by switching your earning preference to American Express Membership Rewards points. In the above example, you’d take home 5 Amex points for every dollar you spend at Macy’s. Since we value Amex points at 2 cents apiece (as of November 2024), thanks to the array of transfer partners and valuable redemption options, that could offer an even higher return for your online purchases.

However, the bonus for new members who join via a referral link is usually only available as cash back. You can link your Membership Rewards account after joining, but the one-time bonus will be paid in cash (after qualifying purchases). That said, if a friend or family member joins through your referral link (and completes the spending requirements) after you switch your earning preference to Amex points, you’ll earn bonus points instead of cash back based on whatever referral offer is available at the time.

Note that going through Rakuten for your online purchases may mean sacrificing higher rewards that you would earn through something like an airline shopping portal?— especially if there are any bonus offers through those sites. It’s always a good idea to compare earning rates using a shopping portal aggregator.

Which credit card should I use?

If you’re making purchases online, pay close attention to any potential bonus categories. One great example is PayPal since you can earn 5% back through the end of 2024 with the Chase Freedom Flex? after activation on up to $1,500 in total purchases each quarter you activate. However, your best bet may be to use a card that offers solid value for everyday purchases, such as:

- Capital One Venture Rewards Credit Card: 2 miles per dollar spent on purchases

- Capital One Venture X Rewards Credit Card: 2 miles per dollar spent on purchases

- Citi Double Cash? Card (see rates and fees): 2% cash back on all purchases (1% when you buy and 1% when you pay your bill), with the option to combine your rewards with Citi ThankYou Rewards points-earning cards for even more value

- The Blue Business? Plus Credit Card from American Express: 2 Membership Rewards points per dollar spent on eligible business purchases (on the first $50,000 in purchases each calendar year, then 1 point per dollar); terms apply

- Chase Freedom Unlimited?: 1.5% cash back that can be transferred to a Chase Ultimate Rewards points-earning card

Remember that any cash back or Amex points you’d take home through Rakuten come in addition to the earnings on your credit card. You may even be able to stack an Amex Offer or Chase Offer at select merchants, so be sure to check those first to avoid leaving money on the table.

For example, holders of The Platinum Card? from American Express enjoy up to $100 in statement credits at Saks Fifth Avenue every calendar year (up to $50 from January through June and another up to $50 from July through December; enrollment is required). Since Amex applies these credits on the back end — as opposed to via a promo code at the time of purchase — you should still earn the cash back or bonus Amex points on the full subtotal of your purchase by starting at Rakuten and clicking through to Saks. Enrollment is required.

Related: Things to consider for your holiday shopping credit card strategy

Bottom line

This new referral offer is simple, and anyone can use it, so don’t miss out on an easy $40 for online shopping. Sign up for Rakuten today, or refer your friends and family members to reap the rewards of their online purchases.

Related reading:

]]>