Needless to say, I jumped on the chance to fly straight from Denver to Europe for only 30,000 miles round-trip later this year. But since my partner and I were already planning — and paying for — our wedding and honeymoon in October, we decided we would only book the trip if we could get all of it (including airfare and lodging) for basically free using points and miles. Here’s how we did it.

Related: Why you should use points and miles to book holiday travel

Booking Air France award flights with Capital One miles

Not only did Flying Blue’s July Promo Rewards include flights to and from our home base, Denver International Airport (DEN), but they also included several European destinations. We had our pick of cities in France, Spain, Germany, Sweden, Norway and more.

We ultimately narrowed down the list based on which dates worked best for us and which cities had plenty of hotel options that we could book with our Marriott Bonvoy and World of Hyatt points. We also considered European train routes because we knew we wanted to check an overnight train off our bucket list.

We settled on flying into Prague a few days before Christmas and flying out of Brussels a week later. We would spend three days exploring Prague’s magical Christmas markets, then take the European Sleeper to Brussels and end our trip with two days in the Belgian capital. As an Agatha Christie fan, I was particularly excited to explore Brussels, the home of one of my favorite fictional characters: detective Hercule Poirot.

Our flights from DEN to Prague cost 15,000 Flying Blue miles plus $116 in taxes and fees, and our flights from Brussels to DEN cost 15,000 miles plus $182 — for a total of 30,000 miles and $298 per person.

Our tickets are economy standard, meaning we’ll each get a free checked bag, carry-on and personal item. Interestingly, our journey home from Brussels is one of Air France’s combined plane-plus-train tickets, meaning we’ll depart from the Brussels South/Midi Train Station (ZYR) and take a train to Paris-Charles de Gaulle Airport (CDG) for our flight to DEN.

I’m not a frequent Air France-KLM flyer, and my Flying Blue account held a whopping 0 miles. No problem — I collect Chase Ultimate Rewards points and Capital One miles, both of which are transfer partners with Flying Blue.

Chase has a wider selection of transfer partners that I often use, like United Airlines MileagePlus, Southwest Airlines Rapid Rewards, Marriott Bonvoy and World of Hyatt. I have a harder time redeeming my Capital One miles because they don’t transfer to most of my favorite programs. Therefore, I decided to use Capital One miles for this redemption because I’m less likely to find other uses for them.

I happened to have just over 60,000 miles in my Capital One account, so I happily transferred these to Flying Blue and saved my Chase points for future redemptions. I spent a grand total of 60,000 miles and $596 for two round-trip flights to Europe — not bad for tickets that would have cost roughly $3,200 total in cash. I ended up getting a value of around 4.3 cents per mile, significantly higher than TPG’s October 2024 valuation?of 1.3 cents for Flying Blue miles and 1.85 cents for Capital One miles.

Related: Ultimate guide to Capital One’s airline and hotel transfer partners

Booking an upscale Prague hotel with Hyatt points

As a Hyatt loyalist who holds the World of Hyatt Credit Card, I scoped out my Hyatt lodging options in various European cities before booking our flights. One reason we chose Prague was that it had two well-reviewed Hyatt properties near the downtown area.

I could have gotten great value from my World of Hyatt points at the Category 1 Lindner Hotel Prague Castle, where basic rooms were going for $140 or 6,000 points per night on our dates. This would have provided an excellent value of 2.3 cents per point, well above TPG’s October 2024 valuation of 1.7 cents each for World of Hyatt points, showing that Category 1 Hyatt hotels are a great way to get maximum value from your points.

But the Lindner Hotel wasn’t as centrally located as we were hoping. Since we only had a couple of days to explore Prague and we would be visiting in the coldest month of the year, I was willing to spend more points on a more convenient location. We ended up booking three nights at the Category 6 Andaz Prague, a snazzy hotel within easy walking distance of everything from the train station to the Christmas markets, for a total of 83,000 points. Since the cash rate was $1,266, we got a value of 1.53 cents per point — on the low side for Hyatt points. However, it was the best option for our needs and still saved us over $1,000.

I had around 50,000 Hyatt points saved up from recent stays and spending on my World of Hyatt Credit Card; the rest I transferred from my Chase Ultimate Rewards account. Since World of Hyatt doesn’t charge taxes or fees on award stays, I didn’t have to pay a dime out of pocket.

Related: World of Hyatt Credit Card review: One of the most valuable hotel cards

Booking a historic Brussels hotel with Marriott free night certificates

My fiance had just added the Marriott Bonvoy Boundless? Credit Card to his wallet, and the welcome bonus at the time included three free night certificates worth up to 50,000 Bonvoy points each (offer no longer available), which were burning a hole in his pocket. Since Brussels had plenty of Marriott properties to choose from, he decided to use two of his shiny new free night certificates to cover lodging for our two nights in Brussels.

We chose The Dominican, Brussels, a member of Marriott’s Design Hotels collection that started as a monastery in 1465 and now provides luxurious lodging in the center of the city. Award rates on our dates were 46,000 points per night, allowing us to almost maximize our free night certificates. Since cash rates were around $580 on those dates, that welcome bonus saved us over $1,100 — and we still have another free night to use on our next trip.

Unlike World of Hyatt, Marriott Bonvoy does charge some fees on award stays, but these were minimal. Our total cost for the two-night stay was 8.50 euros, or just under $10 at the time of writing.

Related: The best Marriott hotels in the world

Other expenses

The biggest expense for our Christmas trip was the European Sleeper train, which cost about $465 for a private carrier for two. We booked it with our Chase Sapphire Preferred? Card because it earns 2 points per dollar spent on travel, has no foreign transaction fees, and includes trip insurance. We’ll arrive in Brussels in true “Murder on the Orient Express” style (though hopefully without the murder part) and earn bonus points while we’re at it.

I’m considering booking a guided bike tour of Prague through Hyatt’s Find Experiences platform, where I could earn 4 points per dollar spent with my World of Hyatt Credit Card. And if we eat any meals at our hotels, we’ll pay with my World of Hyatt card or my fiance’s Marriott Bonvoy Boundless card, which earns 6 points per dollar spent on Marriott purchases.

For all other dining, the Chase Sapphire Preferred will give us 3 points per dollar spent. For activities, souvenirs and other purchases that wouldn’t fall into any bonus spending category, I’ll use my Capital One Venture X Rewards Credit Card because it earns 2 miles per dollar spent on all purchases and has no foreign transaction fees (see rates and fees).

Related: The best cards for trip cancellation and interruption insurance

Bottom line

Sometimes, you already have a dream destination in mind and points and miles can help you get there for less — like when my fiance and I planned our lemur-iffic honeymoon in Madagascar using rewards. Other times, when you find a great deal using points and miles, it can inspire you to visit an unexpected destination or try a new experience. Either way, staying flexible in your travel plans can help you get the most value from your points.

]]>Many of the best travel rewards cards provide valuable premium travel benefits. For example, The Platinum Card? from American Express and The Business Platinum Card? from American Express offer many perks, including complimentary entry to Centurion Lounges and extra benefits on luxury hotel stays booked through the American Express Fine Hotels + Resorts program.

But one benefit these two cards offer is often overlooked: the ability to enroll in complimentary elite status with Marriott Bonvoy and Hilton Honors. Here’s what you need to know about hotel status with the Amex Platinum and Business Platinum.

What is this benefit?

Cardmembers of The Platinum Card from American Express and The Business Platinum Card from American Express?— including authorized users with additional Platinum or Business Platinum cards — can enroll in complimentary Marriott Bonvoy Gold Elite and Hilton Honors Gold status.

Once enrolled, you’ll maintain at least Gold status if you keep your Amex Platinum or Amex Business Platinum account open (assuming American Express continues to offer this benefit for your card).

Related:?Complete guide to authorized users on the Amex Platinum Card

How do I enroll?

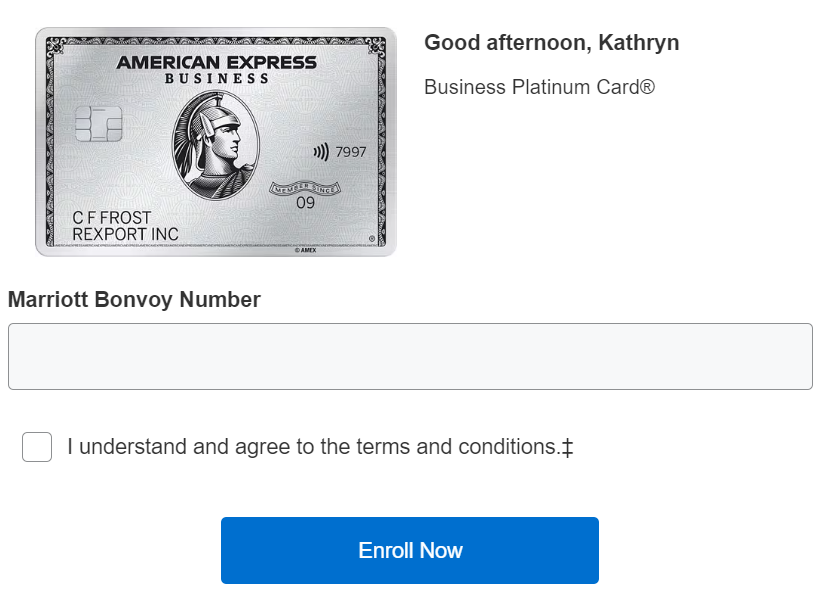

To enroll in either (or both) complimentary hotel elite statuses, log in to your American Express account, click on “Rewards & Benefits” in the top navigation bar and then select “Benefits.” Scroll down — you may need to expand a “Premium Travel” section — to find separate icons for Hilton and Marriott.

Click “Learn More” in either (or both) tiles for more information. If you want to enroll, click “Enroll Now” and enter your member number with the hotel loyalty program. This online enrollment process should work for both primary and additional Platinum cardholders, but you can also enroll by calling the customer service number on the back of your Amex Platinum or Amex Business Platinum card.

Once you request enrollment, American Express will share your enrollment information with the hotel loyalty programs, which will upgrade your status to Gold if you currently hold a lower status. The upgrade usually takes three to five business days but could take longer, so don’t wait until just before a trip to enroll in these benefits.

Related:?Here’s how much value you can get from the Amex Platinum card in your first year

What are the benefits of Marriott Bonvoy Gold Elite status?

Marriott Bonvoy Gold Elite status usually requires you to accrue at least 25 elite night credits per calendar year. As a Marriott Gold Elite member, you’ll have access to the following benefits:

- 25% more points on stays: Earn 25% more points than base-level members on eligible hotel purchases at participating Marriott properties.

- Enhanced room upgrades: The Marriott Bonvoy terms and conditions note that Gold Elite members may receive a complimentary upgrade to “rooms with desirable views, rooms on high floors, corner rooms, rooms with special amenities, rooms on Executive Floors” at participating properties. However, each hotel is left to identify room upgrades; some brands don’t offer complimentary upgrades, and upgrades are subject to availability.

- Late checkout at 2 p.m.: Get 2 p.m. late checkout at participating brands upon request (based on availability).

- Enhanced internet: Enjoy complimentary enhanced internet when staying at participating properties.

- Welcome points: Get 250 or 500 welcome points per stay at participating brands.

In addition to the Amex Platinum and Amex Business Platinum, several Marriott Bonvoy cards provide automatic elite status. For example, you can get automatic Gold Elite status with the Marriott Bonvoy Bevy? American Express? Card and the Marriott Bonvoy Business? American Express? Card. Meanwhile, the Marriott Bonvoy Brilliant? American Express? Card offers automatic Platinum Elite status.

Related:?29 best Marriott hotels in the world

What are the benefits of Hilton Honors Gold status?

Hilton Honors Gold status usually requires that you stay 40 nights per calendar year, stay 20 times per calendar year or earn 75,000 Hilton Honors base points per calendar year. As a Hilton Gold member, you’ll have access to the following benefits:

- 80% elite status bonus on stays: Receive an 80% bonus on the Hilton Honors base points you earn on stays.

- Continental breakfast or a daily food-and-beverage credit: Some brands provide breakfast for all guests as a brand amenity. But at most other brands, you can select a daily food-and-beverage credit (at select brands in the U.S. and at Motto by Hilton properties globally) or daily complimentary continental breakfast (at select brands outside the U.S., excluding Motto by Hilton) for yourself and up to one other guest registered to your room as a MyWay benefit.

- Space-available room upgrades: Gold members may receive a complimentary upgrade to preferred rooms up to Executive Floor room types. The Hilton Honors terms and conditions note that “Preferred rooms may also include those not on the Executive Floor but conferring Executive Lounge access (excluding the Sakura Club at Conrad Washington, D.C and Club Signia at Signia by Hilton hotels), the next-best available room types, rooms with desirable views or amenities or other rooms identified as ‘preferred’ by the hotel and may vary within each brand.” Additionally, upgrades are “granted on a space-available basis for the entire stay,” and some brands and properties don’t participate in complimentary upgrades.

- Fifth night free: Hilton elite members get every fifth night free (up to four free nights per stay) when booking a reward stay of five nights or more using points.

In addition to the Amex Platinum and Amex Business Platinum, you’ll also get automatic Hilton Gold status if you have the Hilton Honors American Express Surpass? Card or The Hilton Honors American Express Business Card. Additionally, you can get automatic top-tier Hilton Diamond status as a perk of the Hilton Honors American Express Aspire Card.

The information for the Hilton Aspire card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related:?The 20 best Hilton hotels in the world

Bottom line

Hilton Honors Gold and Marriott Bonvoy Gold Elite status provide some valuable perks, so it’s great that cardmembers of The Platinum Card from American Express and The Business Platinum Card from American Express?can enroll in these statuses as a perk of their card.

Getting Hilton Gold and Marriott Gold Elite status through the Amex Platinum or Business Platinum can be useful if you don’t stay frequently enough with these programs to earn elite status organically and don’t want to add a hotel credit card to your wallet.

However, having the Amex Platinum or Amex Business Platinum won’t help you earn higher status with either program. After all, unlike select Marriott Bonvoy cards that provide elite night credits as a cardholder perk, you won’t get Marriott Bonvoy elite night credits as a benefit of the Amex Platinum and Amex Business Platinum.

]]>